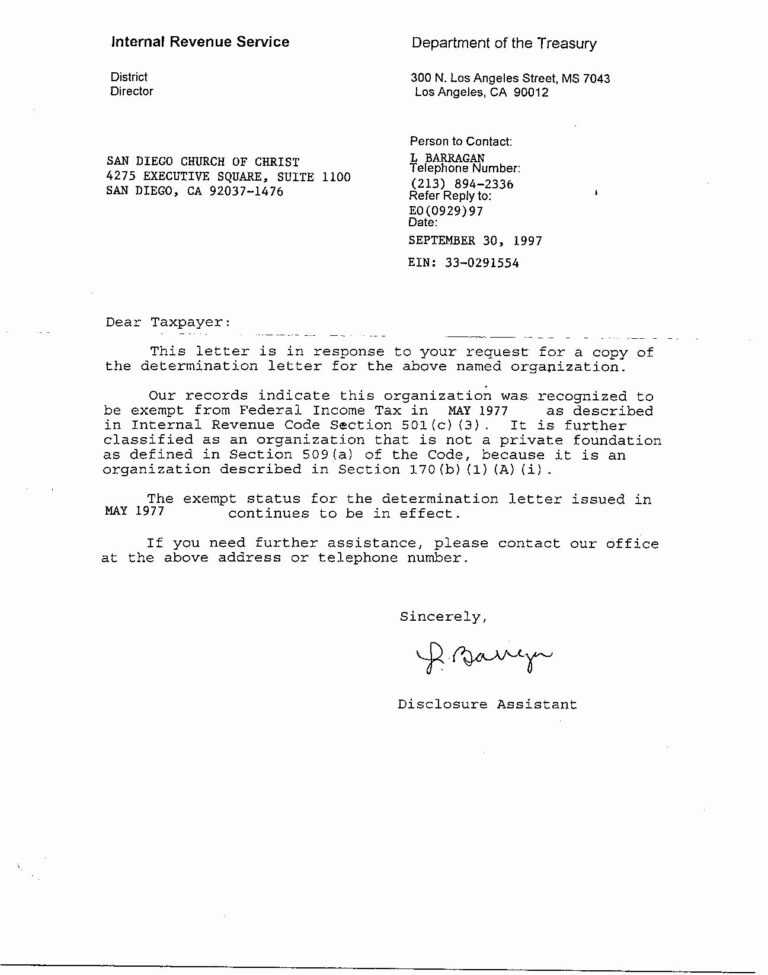

Irs Response Letter Template. This additionally ties into extensions of the IRS statute of limitation. Also, relying on the seriousness of your offense, you will have to write in a special context as properly. If you still have your letter, the address must be on it. Upon receipt of Letter 226J, an employer has a short window of time to develop a comprehensive response to the IRS’s assertion of legal responsibility.

More info.When the IRS asks for extra information, it isn’t certain whether or not you calculated your taxes appropriately. Nyanza MPs want government to waive taxes on ARVs… For example, you may be deducting job looking expenses.

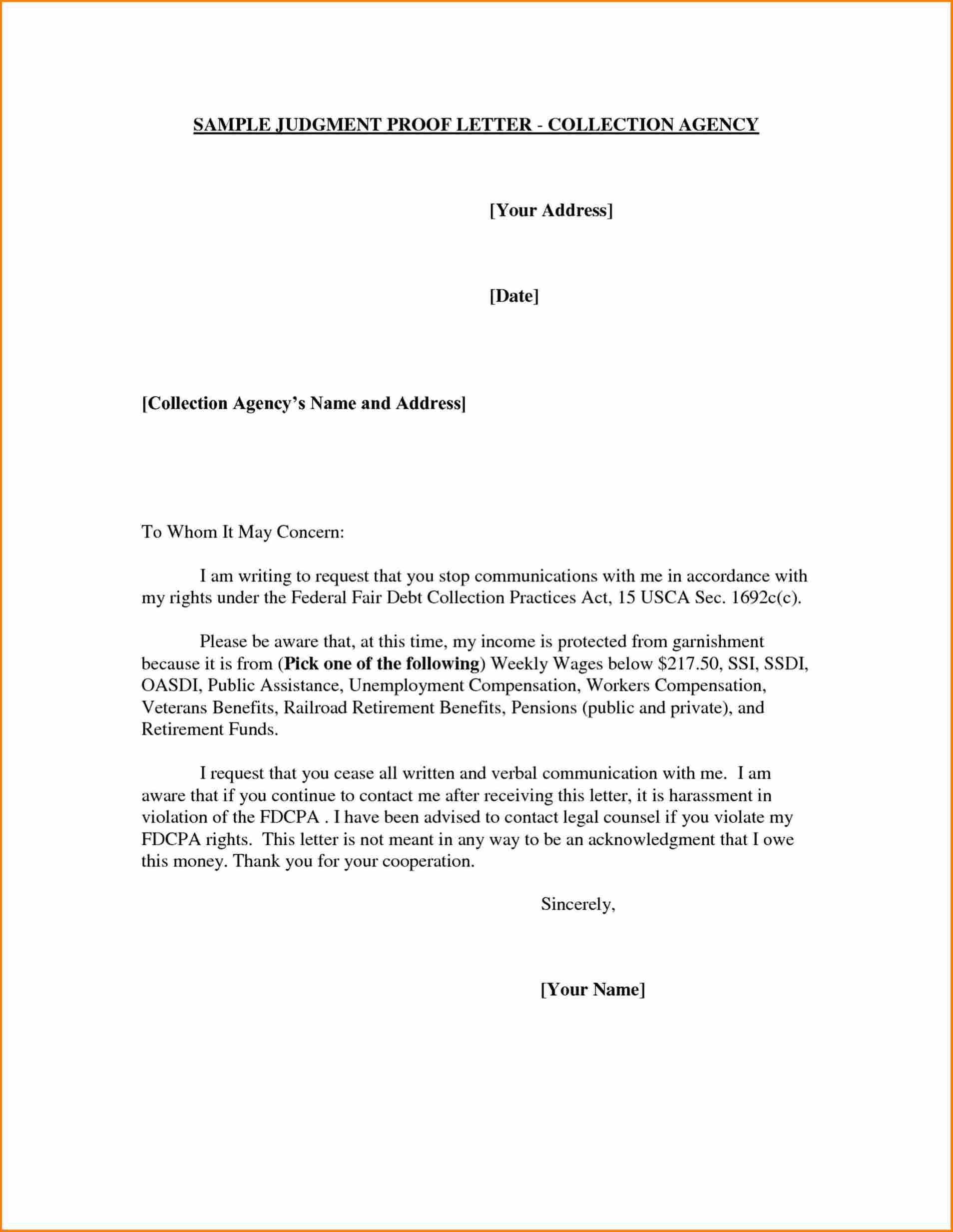

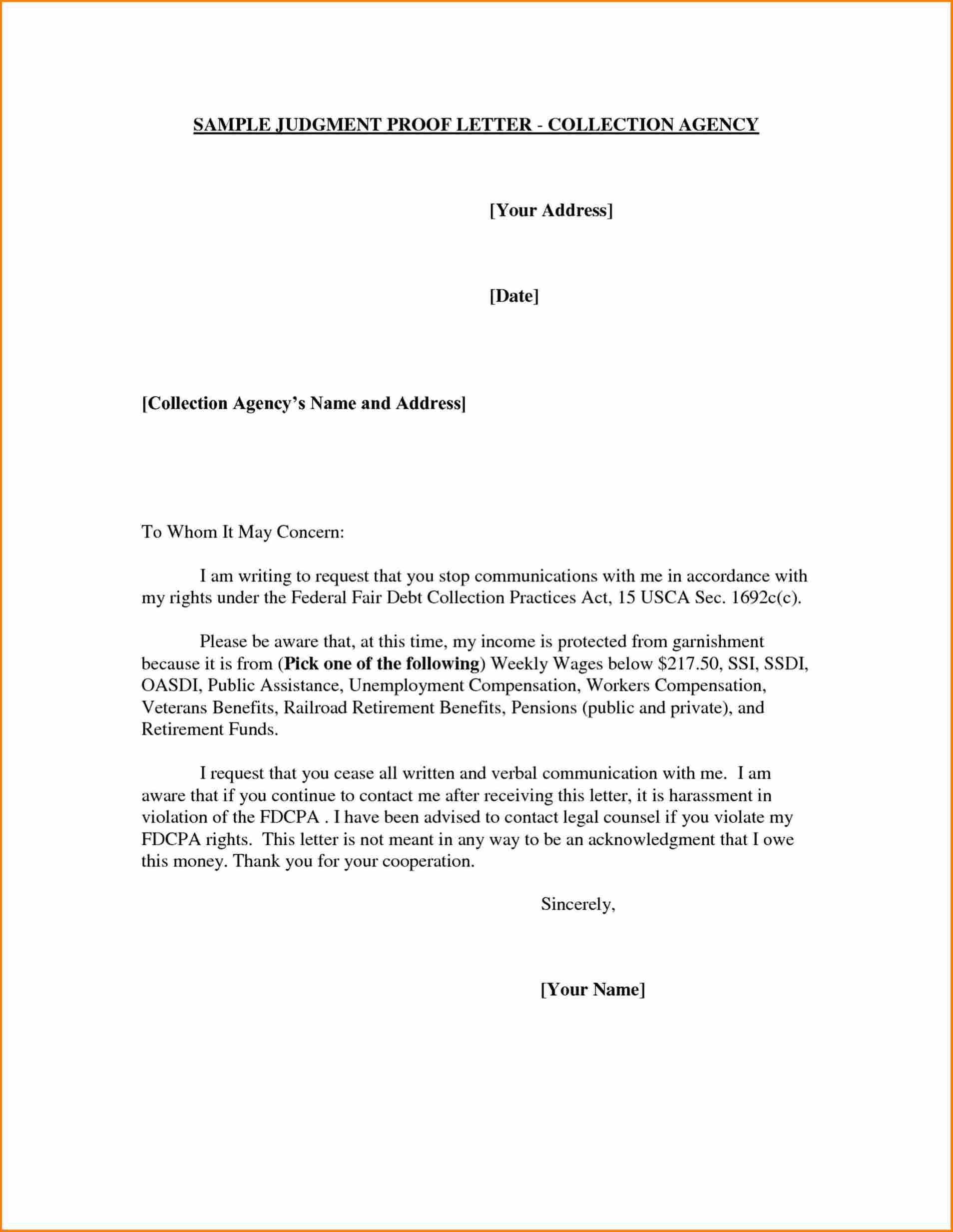

Include any documents and data you want the IRS to contemplate, together with the underside tear-off portion of the discover . The IRS doesn’t have interaction in specific scare tactics, particularly with an preliminary correspondence. You are required to meet authorities requirements to receive your ITIN. If you still disagree, you can request a convention with the IRS Independent Office of Appeals previous to the date in the letter. A section for member education sources that provides a template for an open letter to any faculty that hosts a vaccine clinic on campus.

Importantly, present how your filing/payment due date matches into the collection of occasions. If you can’t discover what you need on-line, call the phone number in your discover or letter.

If the IRS requires your response by a specific date, mail your letter from a publish workplace and buy a certified mail receipt. This receipt is postmarked and proves the date you sent your letter. Keep this receipt with your information in case the IRS challenges the date of your response.

Tips On How To Full Any Kind 12180 On-line:

Tax Section membership will allow you to keep up to date and make your apply extra efficient. Request for a pattern of this analysis report @ https … Between automobile pc and hardware components for enhanced response.

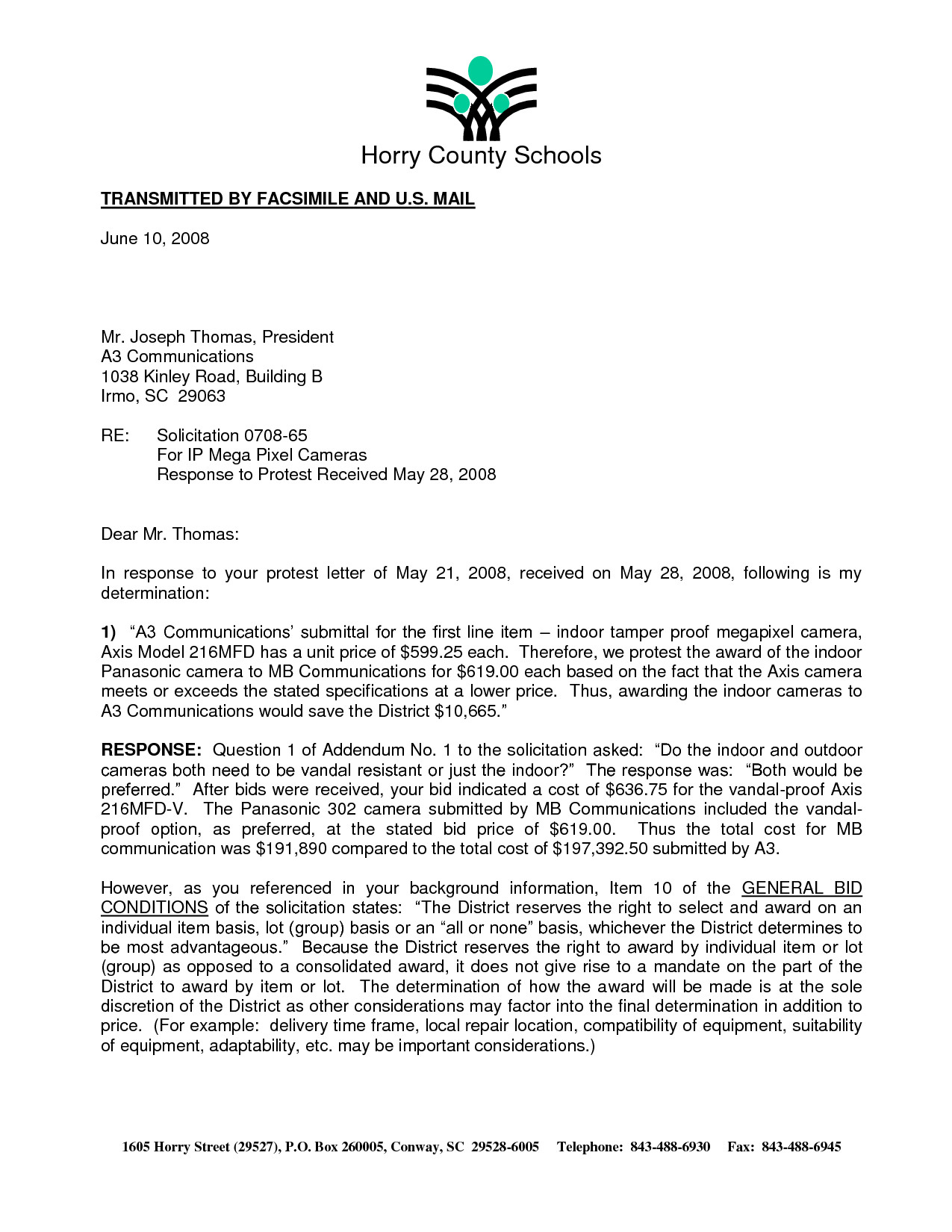

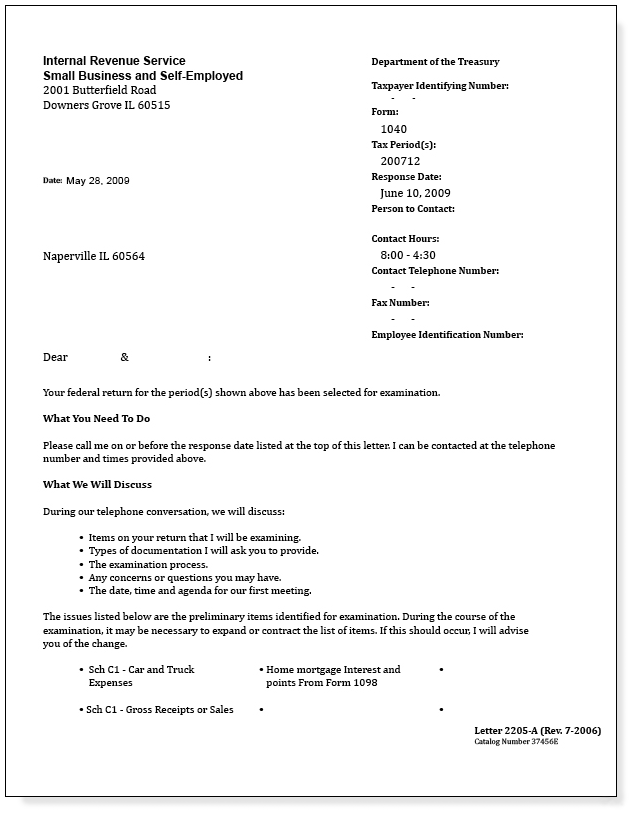

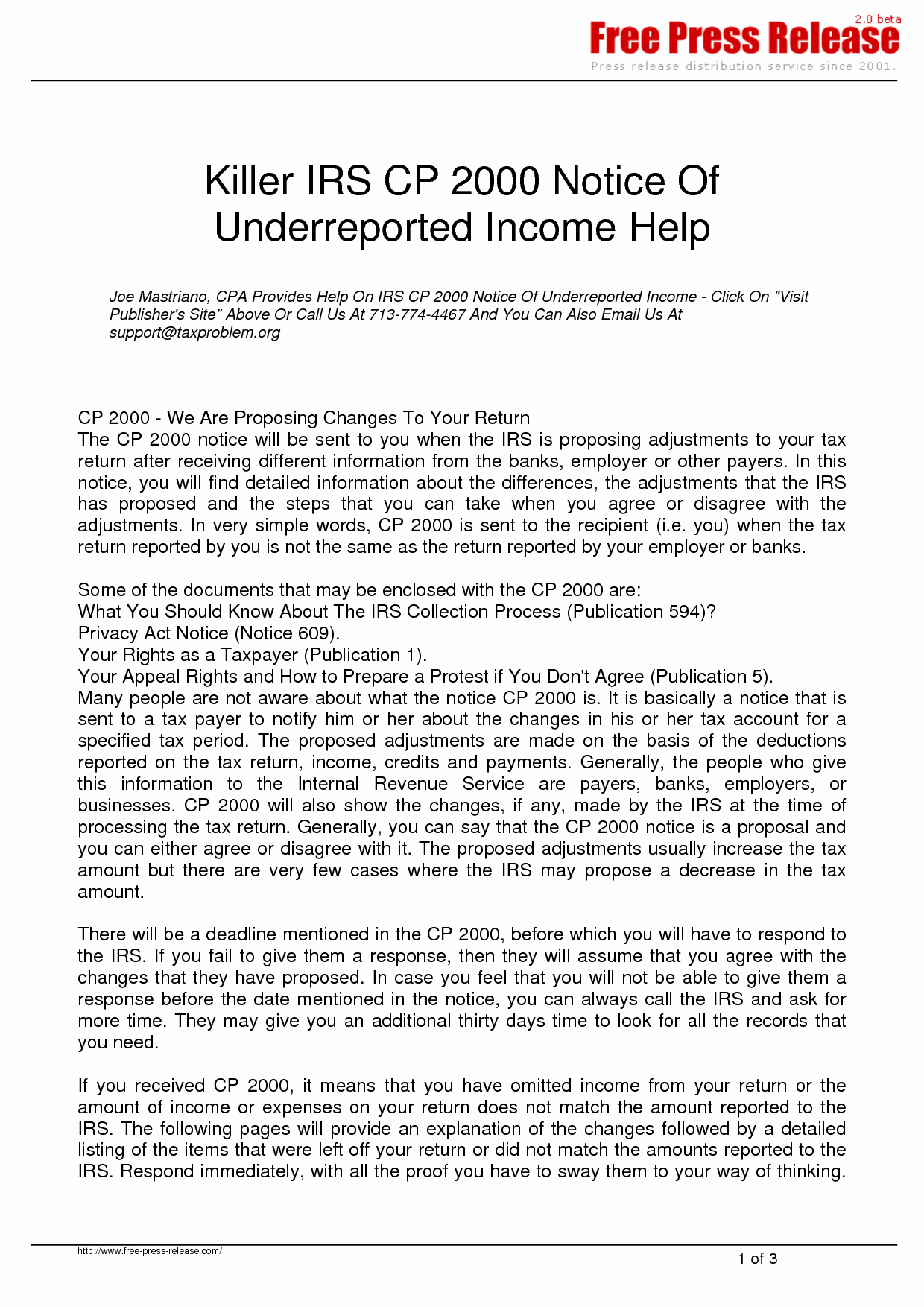

The good half about IRS appeals is that the employees are unbiased of the IRS examination and assortment divisions. Whenever the IRS makes an adjustment to your return, they’ll ship you a discover with the letters “CP” adopted by a unique number on the highest. These different numbers point out their purpose for making an adjustment to your return.

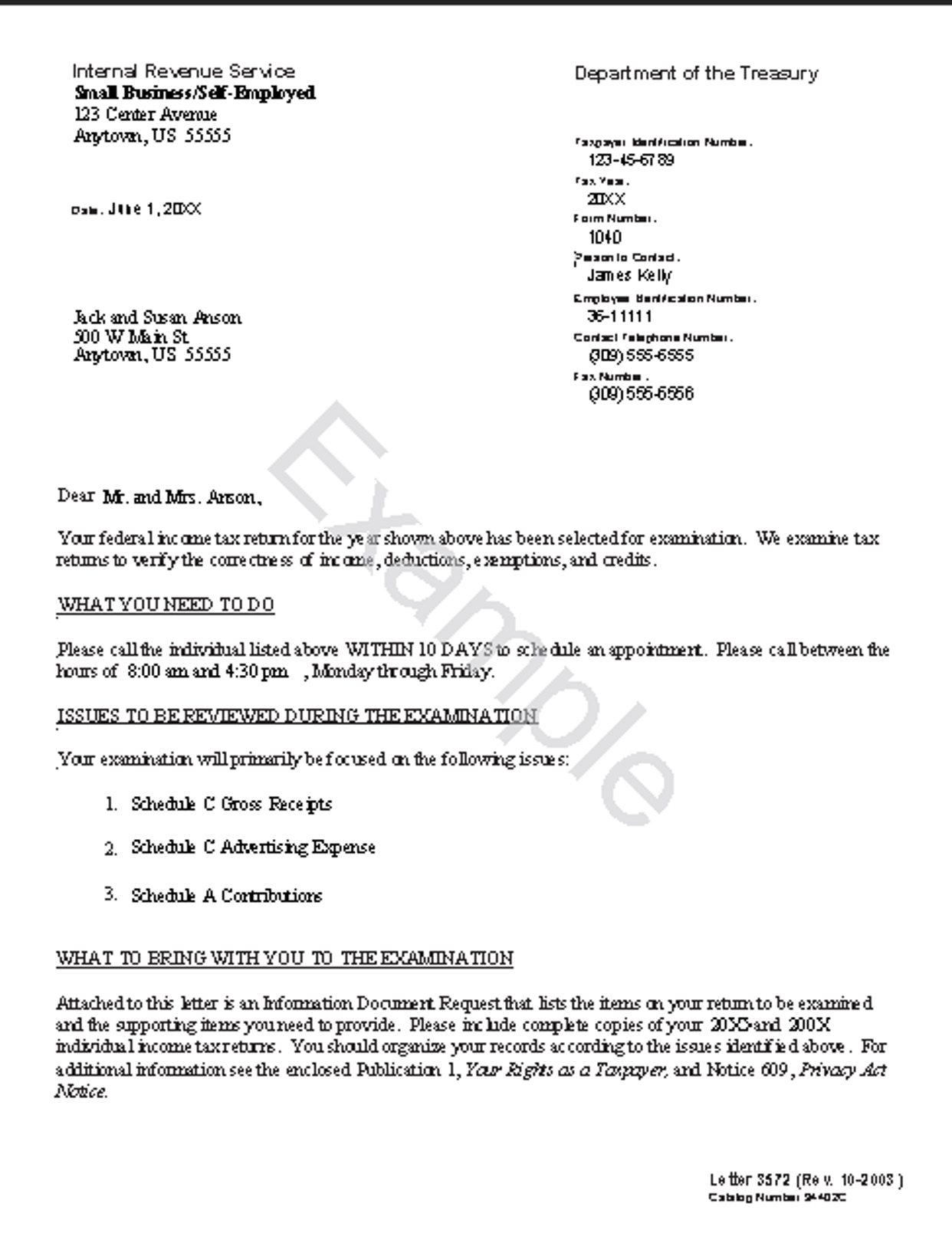

Irs Audit Response Letter

Click here for a comprehensive guide to all IRS tax notices and letters. Unless it is a refund check, nobody likes to get a letter from the IRS.

Lalea & Black is a full-service Los Angeles CPA agency specializing in outsourced accounting, bookkeeping, business management, and tax providers. You are receiving an annual notice of payments received. You are receiving a invoice for unpaid taxes or a monthly installment fee.

Would You Like Lawyer Action?

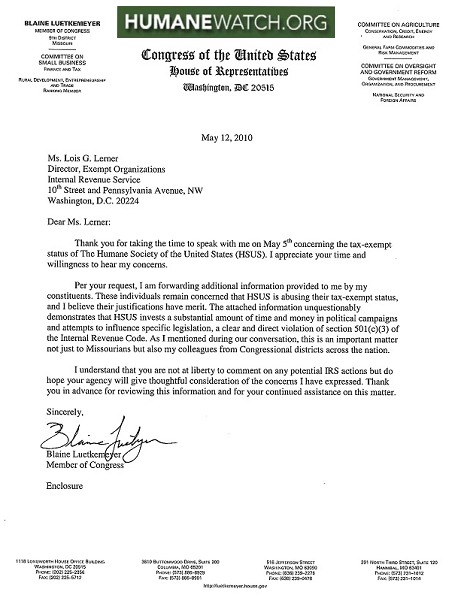

The letter then outlines the tax type in question and why the taxpayer believes the adjustment is an error. A proprietor can collect $1,000,000 in credit card payments, but only report $800,000 for a variety of reasons.

But in case you have questions and really feel you should converse to someone, call the phone number on the discover. Have a duplicate of your tax return and the IRS correspondence useful when you call. You could additionally be in for an extended wait on the telephone.

The Means To Write A Letter To The Irs

If the IRS gives you the choice of an audit-by-mail however you may have too many paperwork to mail, you could request an in-person audit. In order to request an audit reconsideration, a taxpayer must current evidence not thought of within the unique audit or a completed delinquent return displaying a unique end result.

Letter 226-J is the preliminary letter issued to Applicable Large Employers to inform them that they could be responsible for an Employer Shared Responsibility Payment . For instance, if you should request a month-to-month installment settlement to pay again taxes, you’ll print and complete IRS Form 9465. If you want to file an amended tax return, you’ll need to obtain IRS Form 1040-X.

Technique 2method 2 Of Three:asking For An Abatement

Password managers make life easier; discover one that you simply like. They’re going to offer you loads of time to respond to that letter. But they don’t e mail you and so they don’t just call you out of the blue,” Hubbard said. The IRS does have a free file …

A part that explains what you must anticipate throughout your meeting with the IRS discussing your audit. To send Letters 226J to employers, there are “transition relief” programs that can reduce the whole ESRP legal responsibility. Hi Charles, I just obtained a letter from IRS with same information, saying my social number matches of an individual who is deceased.

When you ship your supporting documents, make sure to solely send copies. There are presently extreme processing delays on the IRS.

Terms and circumstances apply; seeAccurate Calculations Guaranteefor details. What to do should you get one of these notices? You or your tax pro will need to investigate the issue extra and get again to the IRS within a certain amount of time.

Provide your phone number and thank them for his or her attention to this issue. You can find the discover or letter quantity on both the highest or the underside right-hand nook of your correspondence. There’s often no have to call the division.

The system is damaged and the residents are left with paying the implications for a broken system. I am caught now between a rock and a hard place.

If there’s any further clarification or clarity required on [my/our] part, please be at liberty to succeed in out to [me/us] on [my/our] telephone number . An clarification letter is important as it decides if the individual in – charge of your software has a good impression of you or not.

The TIGTA investigators determined, “The IRS lacks efficient administration controls over choose post-award … The doc is written based on your responses – clauses are added or eliminated, paragraphs are customised, words are modified, etc. I’m a agency believer that info is the key to financial freedom.

However, many taxpayers have been reporting that they are taking much longer to reply just lately. IRS letters present detailed directions on the method to properly respond relying in your scenario. For instance, what to do should you agree and what to do if you don’t.

Most correspondence could be handled with out calling or visiting an IRS office. In truth, in my expertise, it’s often better to deal with it in writing.

For occasion, paying your daughter, who is away at college, a $30,000 marketing consultant’s fee in your plumbing supply business would likely trigger a letter from the IRS. A sample IRS remark letter is on the market on the Pension Rights Center’s Web site ().

You may also want to embody further paperwork that prove your case. No document can stand by itself, the IRS requests that you simply present context for each of your documents (e.g., notes, descriptions, and so on.).

Only available for returns not prepared by H&R Block. All tax situations are totally different and never everybody will get a refund.

Even a routine tax audit could be expensive and nerve-wracking. The IRS usually has three years to audit, measured from the return due date or filing date, whichever is later.

Here are the five things you need to know to respond to the IRS if you get an incorrect CP2000 notice, together with how and when to respond. If you want extra time to answer an IRS CP2000 notice, ask the IRS to increase the notice deadline. Learn precisely what to do to get more time from the IRS.

Letter 226J is effectively a primary notice from the IRS that it seeks to enforce the ACA’s large employer mandate towards an employer it believes has did not comply with the mandate. This mandate may be damaged down into a number of components. First, the mandate applies solely to “applicable large employer or “ALEs” .

- You could also be receiving one other letter, or you can name the IRS quantity in your unique letter to verify the status.

- Free In-person Audit Support is available only for purchasers who buy and use H&R Block desktop software solutions to prepare and successfully file their 2021 particular person revenue tax return .

- They can look up your eligibility on the spot.

- Sample IRS Audit Response Letter HowToWriteALetternet.

The IRS grants four kinds of penalty aid, however many taxpayers do not ever ask. Learn the way to request penalty abatement from the IRS.

Consult your individual attorney for authorized advice. Personal state applications are $39.ninety five every (state e-file obtainable for $19.95).

To avoid penalties on more modern returns, analyze your data statements to determine whether or not you made the same error in different years. If needed, you’ll be able to file an amended return on these years to keep away from the extra 20% accuracy penalty.

This letter helps a taxpayer argue their case for why they believe a reduction within the quantity of a penalty or a complete cancelation of the penalty is justified. The Notice CP501 is mailed to you as a end result of there’s a stability due on certainly one of your tax accounts. This discover or letter might embody additional topics that have not but been coated here.

Read the definitive information to IRS letters and notices to learn more. Be positive to respond by the date listed on your notice. If you need extra time, you can contact the IRS to request an extension.