Mortgage Gift Letter Template. You should include present size, the property handle, and the donor’s relationship to the purchasers. Truly distinctive and we love that Karen continues to work with us via the closing course of. As a part of this course of, you will normally provide two months of financial institution statements to your lender. Unlike common FHA down payment presents, FHA fairness items can solely happen between relations.

The donor of present equity would want to complete and signal the present letter, just as if the gift got as monetary funds. While our site will offer you factual information and common advice to assist you make better choices, it isn’t a substitute for skilled advice. Anyone receiving a present should let the donor know upfront about this requirement.

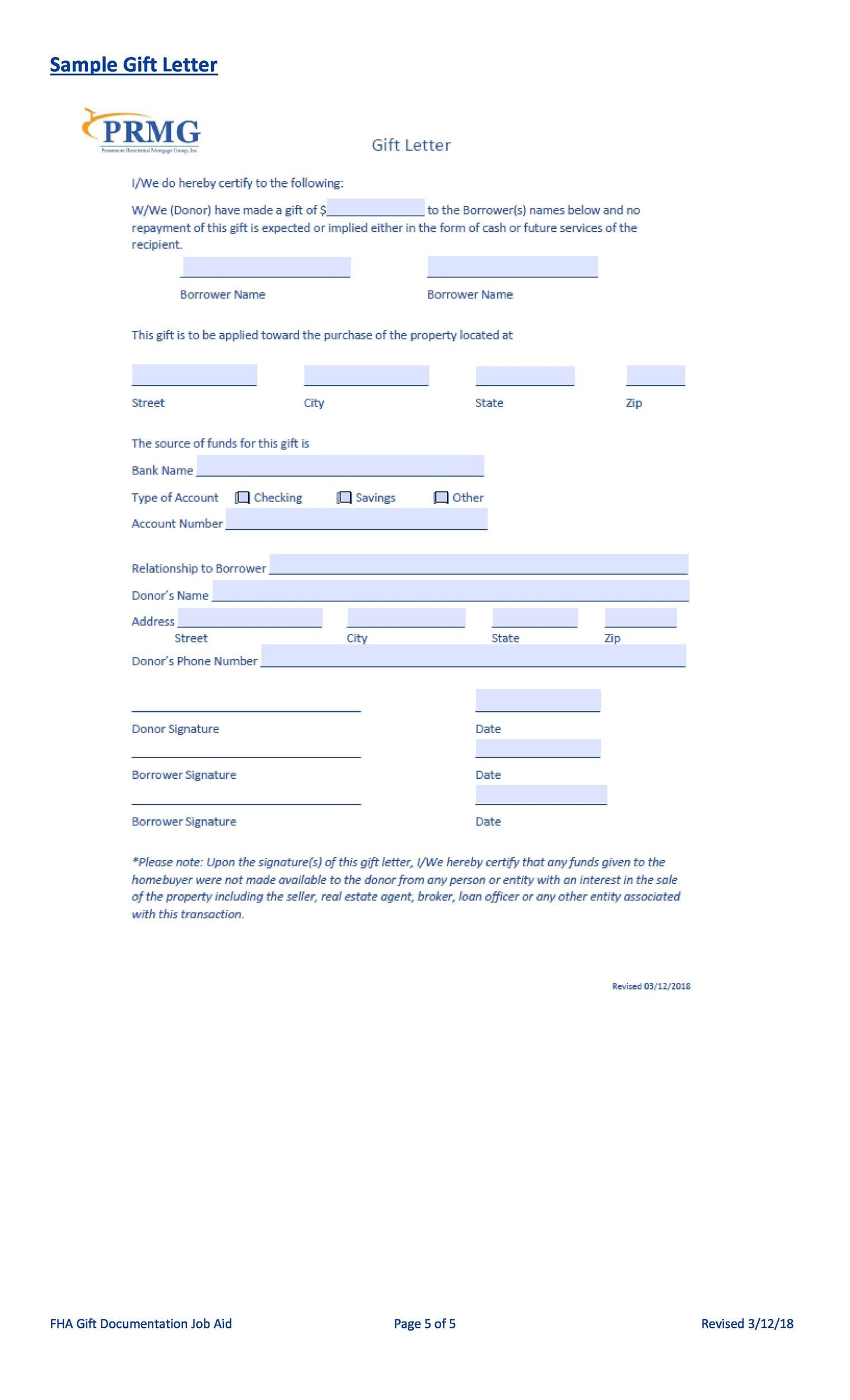

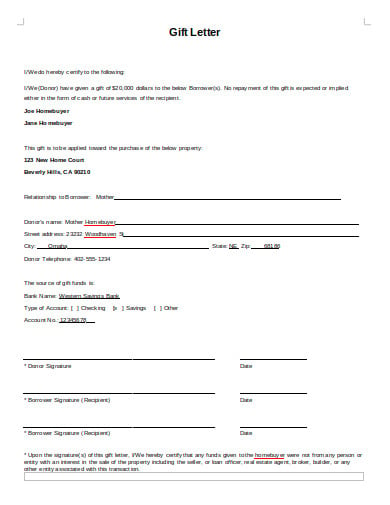

During the mortgage course of, your mortgage officer is going that can help you get your mortgage gift letter and different required mortgage documents squared away. Loans require reimbursement, which provides to the buyer’s debt load, throwing off their debt-to-income ratios, presumably precluding them from successfully executing the mortgage. Gift cash should not be acquired and saved at residence as paper cash by the recipient. As of 2022, an individual can present as much as $16,000 tax-free. Generally, your donor can reward as much as $15,000 while not having to report it to the IRS, as this won’t incur the federal present tax.

A married couple submitting collectively can reward as a lot as $30,000 free from any tax penalties. The IRS does not require any additional filings if the criteria above are met.

Fairway just isn’t affiliated with any authorities businesses. These materials usually are not from VA, HUD or FHA, and weren’t approved by VA, HUD or FHA, or any other government company.

Mortgage Deposit Present Letter

Engaging a mortgage dealer earlier than renewing can help you make a better determination. Mortgage brokers are an excellent source of knowledge for offers particular to your space, contract terms, and their services require no out-of-pocket charges in case you are well qualified.

Sign the form with the help of e-signing instrument. Draw, type, or scan your signature, whichever matches you probably the most. I am a first time buyer and am very lucky to have the ability to have some assistance from my dad and mom in direction of the property.

Am I Ready To Esign The Fha Present Letter Without Creating An Account?

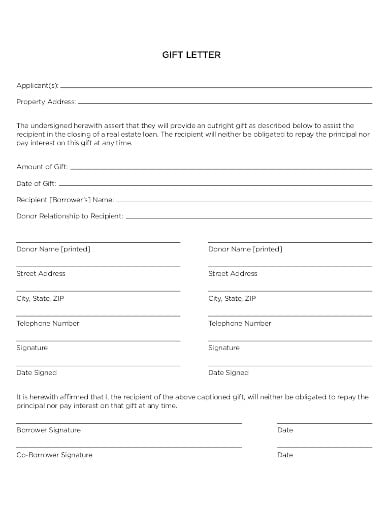

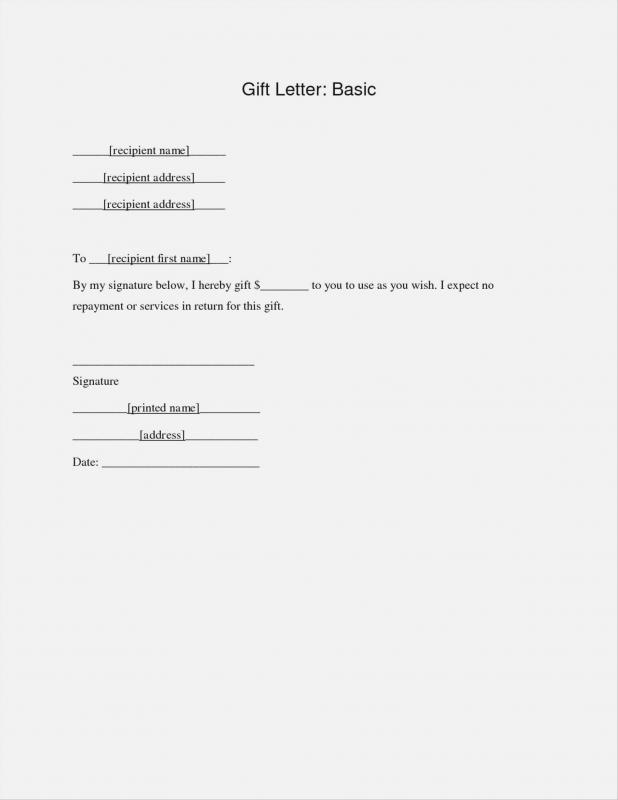

A present letter is a press release that ensures your lender the cash that came into your account is a present and never a loan. The one who gave you the cash should write and signal the gift letter in addition to present their personal info. Mortgage reward letter affidavitke smartphones and tablets are actually a ready business different to desktop and laptop computer computer systems.

Ask donors to supply a mortgage present letter once your offer is accepted and before you shut on the home. Once the reward letter is full, you’ll have the ability to provide documentation to your lender.

Present Letter Rules For Va Loans

Donor requirements differ by lender and mortgage program. Depending on the kind of mortgage you’re getting, there are different rules concerning who can provide a down payment reward to you. Down payments are one of the largest hurdles to purchasing a house.

Keep one copy in your records and give one copy to the customer — the lender will want to see it as a part of the method. There’s a 3-step process when accepting a cash downpayment present and it would not matter what your loan type — Conventional, FHA, VA, or other — the 3-step course of is similar. With a 20% downpayment, residence consumers can typically qualify for the bottom mortgage charges offered by their bank; and with 20% down, there isn’t a accompanying non-public mortgage insurance coverage .

The Means To Create An Digital Signature For The Present Letter Fha Form On Ios

We are within the course of of buying a home; the bank is asking us a down fee of 25% we’ve the cash however we’ve it money now we didn’t know that we couldn’t pay the in cash till now. The financial institution told us that we can obtain a gift from a member of the family after which we could give them the cash.

- In order to do this, make sure to keep an extra-strong paper path for the money being gifted.

- This is proof that the intangible fairness has been transferred from the vendor to the client.

- Put merely, a gift letter for a mortgage is a formal letter stating that funds from a donor are a present that never needs to be repaid.

- If you’re making a down cost of 20% or extra, all funding for the down fee can come from the present.

For most mortgages, you can use reward money to find your down fee. In 2019, 32% of first-time home buyers obtained a present or loan from a relative or good friend towards their down cost, based on a 2020 report from the National Association of Realtors. If you have to share the gift letter map with different events, you can send the file by electronic mail.

Lenders need to know that you’ve the means to pay back your loan. If you have a big present you wish to use in your down payment, you would possibly run into hassle through the underwriting stage of getting your mortgage.

Tips On How To Write A Mortgage Reward Letter On Your Down Fee

Renee Sylvestre-Williams is a finance and enterprise reporter. In her more than 10 years of journalism, her work has been printed in the Globe and Mail, Flare, Canadian Living, Canadian Business, the Toronto Star and Forbes. She also publishes a biweekly newsletter,The Budgette,where she supplies financial schooling for single earners.

Because the signNowwork for your mortgage is entered into the record, a present letter is then a legally binding document that when signed with the intent of the cash as a mortgage, the buyer is mendacity. For all intents and purposes, it is a form of mortgage and financial institution fraud. Some residence consumers battle to avoid wasting the money for a house deposit.

So lengthy as the gift’s intentions and letter are honest, there are not any actual dangers in signing a letter. The solely time points can manifest is when donors provide a loan disguised as a gift. Providing “gift” money that is actually expected to be repaid is a type of deception that can outcome in potential mortgage fraud on behalf of each events concerned.

Gift money should not be acquired and stored at residence as paper money by the recipient. Wire funds are permitted supplied acceptable documentation verifying the wire originated from the donor’s account.

Gift letters reassure your bank that the money you’re receiving is a gift, not a mortgage. Loans aren’t allowed for use for a down cost because they add to your debt load. Your bank is attempting to ensure you pays your mortgage, and including an extra debt makes that less doubtless.

Government companies or public bodies that support low to moderate income households and first time house patrons. In some cases, there may be limits on the quantity of your down payment that comes from another supply. If you’re buying a second residence, for instance, a certain portion of your down payment might have to come from your personal money.

If you may be on a private connection, like at residence, you can run an anti-virus scan in your gadget to make sure it isn’t contaminated with malware. Chat with us or register for our free residence buyer curriculum to reply your whole residence buying questions. Each submit edited and fact-checked by business consultants to ensure that we are providing correct info for our readers.

The Checklists below have step-by-step instructions for transferring property after somebody dies. Go to Courts & Agencies for information about the court or company that may handle your case. You’ll discover hyperlinks to legal help places of work and lawyer referral providers beneath Find A Lawyer.

You’ll want “evidence of the deposit from the donor, a replica of the check or wire assertion matching the donor name, and a duplicate of the closing disclosure matching the gift quantity,” he stated. More than half of first-time homebuyers final yr received financial assist from pals or family that they applied toward their down cost, per a survey performed by HarrisX for Realtor.com.

The IRS defines a gift as “Any transfer to a person, either directly or indirectly, the place full consideration (measured in cash or money’s worth) is not acquired in return.”. As far as a mortgage is concerned, presents are sometimes allowed towards the areas mentioned earlier on this article. But it could be very important understand how the IRS treats a gift specific to a borrower and donor transaction.

These funds couldn’t be used for the down cost, but closing costs only. Using gifts on USDA and VA loans isn’t as frequent, as a end result of these are each zero down payment programs. However, borrowers may find themselves in a state of affairs where they want to receive a present for these loan varieties.

To purchase a home in Canada, you have to have a down fee. The minimum down payment you want is determined by the acquisition value of the house.

I will give my son John Smith a complete of $50,000 to help him to purchase a property. This present is unconditional, non repayable and non refundable.

It might not instantly make sense how much paperwork it takes simply to deposit and use a money present. It might be the deciding issue between whether or not you or not you can afford to purchase a house.

You do not want to bring cash to closing from multiple savings accounts. This, too, could make things troublesome on a financial institution and the aim is to keep things easy.

These brief paperwork are important for finishing the purchase process and getting into your new home. But crucial rule concerning gift funds is that the donor must agree and put in writing that the gift funds usually are not required to be paid back.

The FHA definition of relations is type of broad, and contains domestic partnerships, in-laws, and adopted kids. According to HUD 4000.1, The most LTV share for Identity-of-Interest transactions on Principal Residences is restricted to eighty five p.c.

Not having the wanted paperwork can lengthen the process considerably. File any wanted paperwork in a well timed method to expedite the transfer of the deed according to New Jersey state legal guidelines. Rocket Mortgage provides numerous choices to clients’ family members once they inherit a home.

Mistating reward funds also can put your loan qualification in jeopardy, as all forms of lending must factor in your debt-to-income ratio. This is a question that commonly comes up among debtors who are receiving reward money from their dad and mom for his or her first residence down fee. What can influence the quantity gifted is the character of the mortgage, the borrower’s credit, and subsequently, the down cost amount.

Saving for a mortgage down fee is a giant challenge for many people, especially first time house patrons. Fortunately, many of the most popular mortgage applications allow gifted funds – money given to debtors, for a mortgage down payment, from accredited donors. Gift funds can help debtors close the financial gap and make buying a home a reality.