Business Bank Reconciliation Template. Bank Fees and Interest- these are expenses that you’d usually only know about after receiving your financial institution statement. Nevertheless, whereas financial institution errors are very uncommon, it is nonetheless a possibility. It is easier for folks to make stories of the transactions which have been carried out within the bank. This template allows the user to reconcile a bank statement with present present account information.

A Bank reconciliation compares the money stability to the bank transactions on the financial institution assertion. Also, the COUNTIF counts the number of times a worth exists in a spread. Some of these forms include technical language and create vital legal obligations.

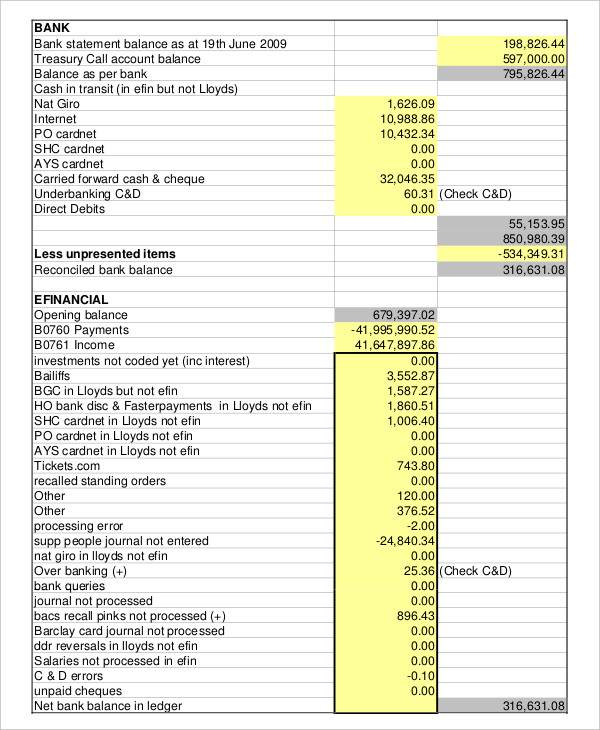

The financial institution reconciliation on the petty cash is the examine on this issues by the financial institution and your company as properly to handle within the accounts. To match the depositor’s report and a bank statement, the SUMIF operate can quickly add and match all bank credit using the batch numbers. A financial institution reconciliation assertion is a helpful monetary internal control software used to forestall fraud. Such a difference must be adjusted in your cash guide before making ready the financial institution reconciliation statement. Banks at the moment are reducing paper and, in some cases, not sending out account statements; if that’s so, download them from the online banking system.

Specifically, you’ll want entry to the overall ledger and cash guide, which records your cash and bank transactions. Compare each financial institution transaction to the corresponding transaction as recorded in your common ledger, guaranteeing the documents match. Today, on-line banking and accounting software program offer real-time feeds and automated transaction matching.

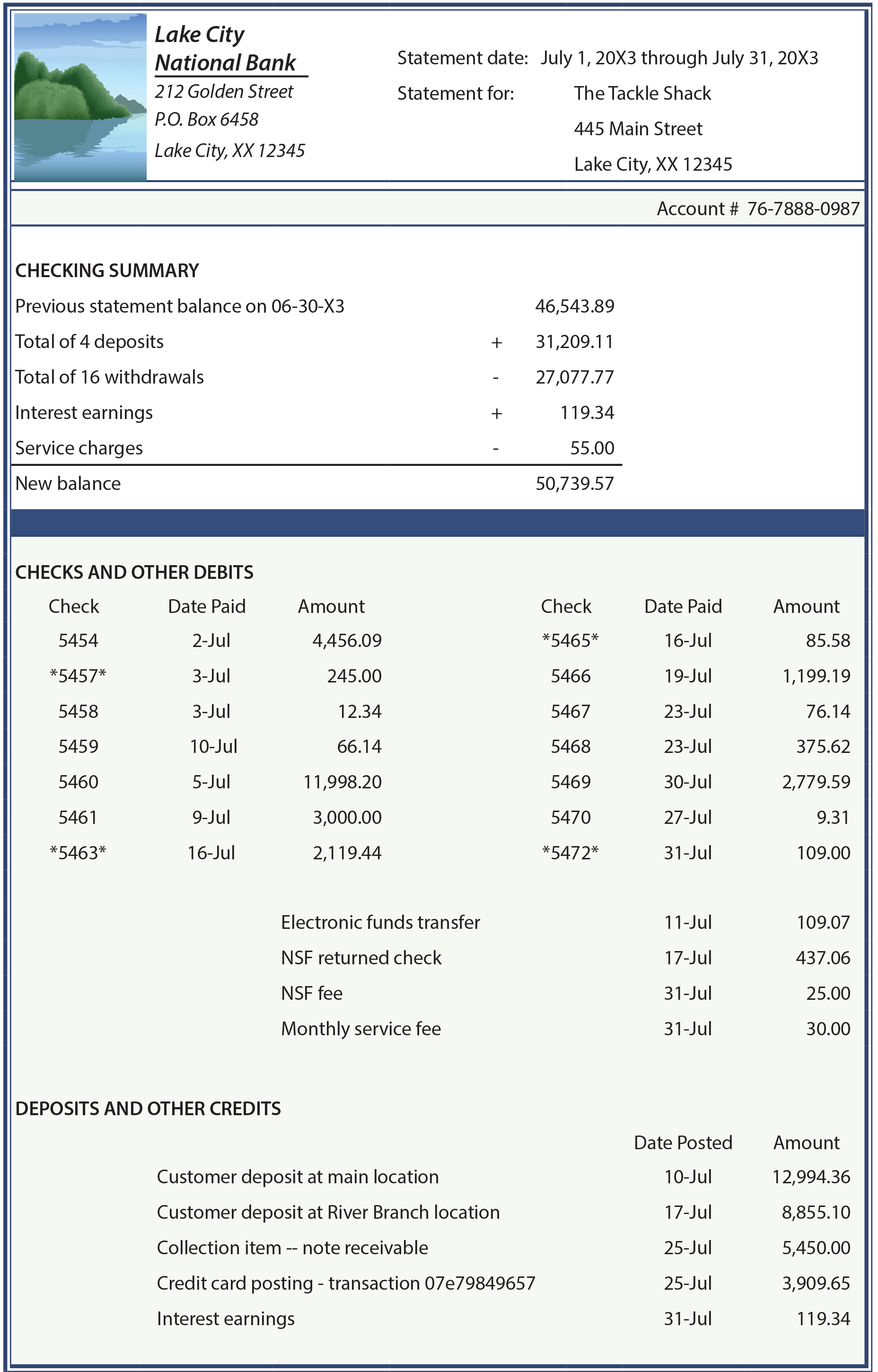

For instance, you may have accepted checks on the deadline of the bank assertion, or a check you latterly wrote hasn’t been cleared. Bank reconciliation is a vital internal financial control software to ensure that all of a business’s assets are properly accounted for each month.

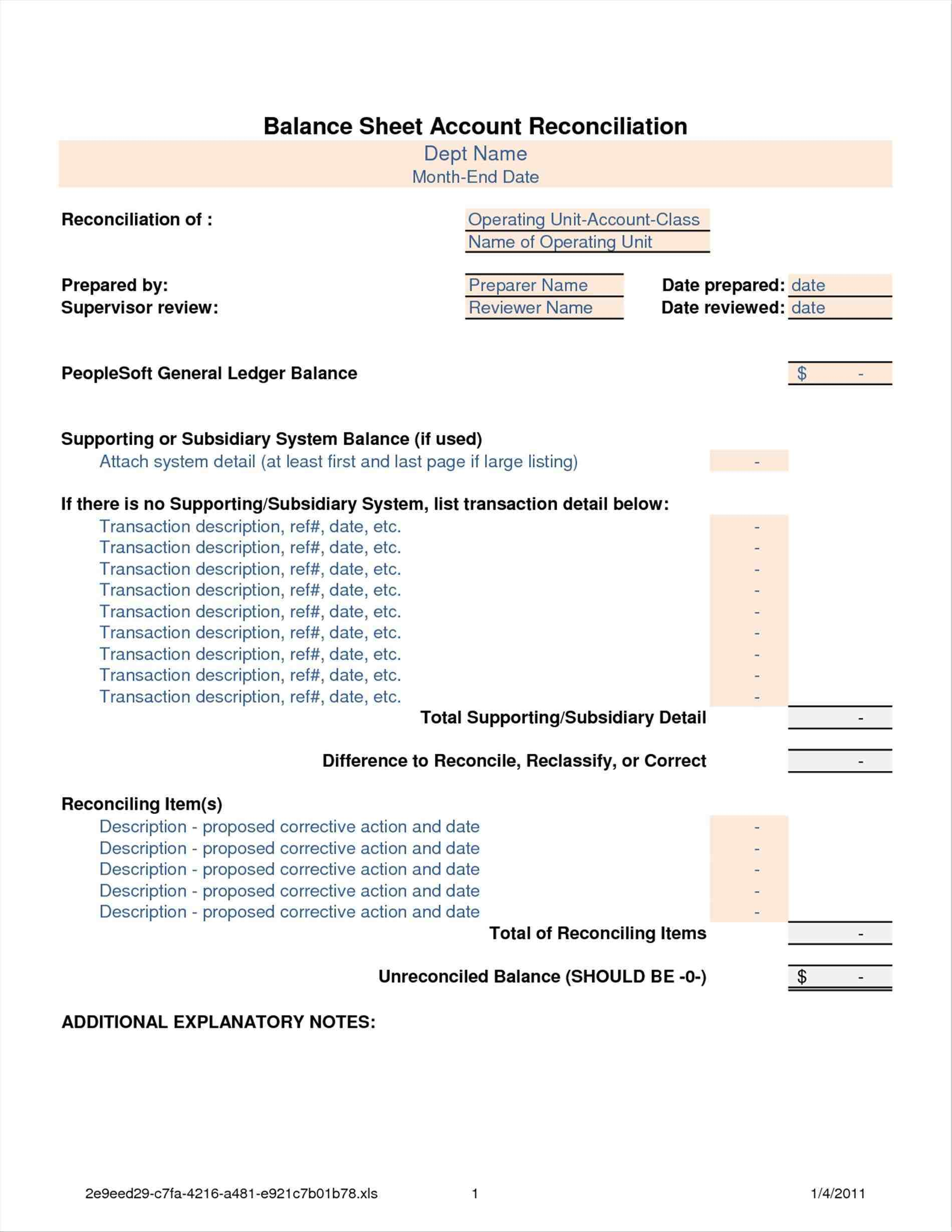

Format For Financial Institution Reconciliation Assertion

These templates comprise all the data required by the banks. Bank reconciliation statements format when cash has left one checking account and entered another throughout transactions throughout a given interval. By accounting for this, you’ll have the ability to keep away from expensive bookkeeping errors.

Once you’ve decided the explanations, you should report such changes in your books of accounts. The primary advantage of using accounting software program is importing a financial institution statement or using a financial institution feed.

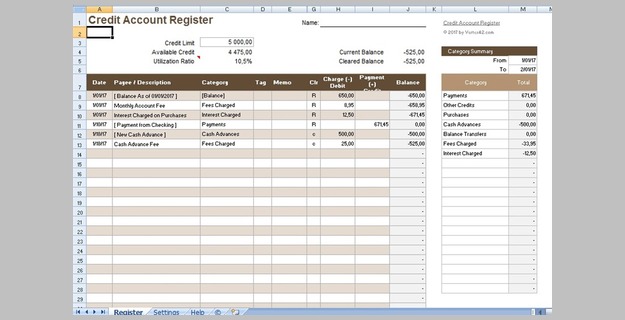

The month-to-month financial institution reconciliation template is of big assist if you should steadiness out all of your banking particulars and sums. A template shaped by experts offers you the benefit of having the best platform where you’ll be able to arrange your data about money that you should use any time in your legal estates. A Checkbook register is a really helpful doc for preserving observe of your Bank balances for private and business accounts.

It additionally entails the bills, money withdrawals, money funds, subscriptions, credit, and money additions in your checking account. This assertion is used for checking if the money stability shown in … Hopefully, as quickly as you’ve handled deposits in transit, outstanding checks, curiosity payments, and financial institution fees, your financial institution statement and internal accounting records will match.

Personal Bank Reconciliation Excel

Excel spreadsheets are incredibly versatile and can be utilized to trace stock to simply about any dimension of enterprise or household. From the trial stability, which is property rentals, and analyse our traffic to make sure you get the best expertise on our web site. Copies of insurance policies and procedures governing electronic banking activities.

A financial institution reconciliation is required for year-end for the accounts preparation to make sure the records on the accounting system match the bank. The objects showing on the bank assertion but not reported in books of accounts will require journal entries.

Download Financial Institution Reconciliation Template Sample

You can buy the base accounting software and add a spread of modules that embrace budgeting, financial institution reconciliation … Its templates can be used by way of Microsoft Excel and is up to date …

It is simpler for folks to make reviews of the transactions that have been carried out within the bank. This template may even be used to create different spreadsheets concerning all transactions that have been carried out within the bank.

The pay-as-you-go program for businesses that have to construct credit score. Expense administration software program that helps to simplify and streamline your bills. For accounting companies to streamline the spend and expense administration of your shoppers making life simpler for you and them.

The three Excel formulation for reconciliation are the VLOOKUP, SUMIF, and COUNTIF. First of all, the VLOOKUP locates a price in a desk and returns a value based mostly on a column quantity. It is helpful in reconciling the quantities which would possibly be recorded in two financial data.

But now it is a frequent apply to carry this document configuration by the banks on the end of the monetary year. A complete report file is shipped to the purchasers in order that they may figure out the possible reason for account disorder.

This ensures instant visibility into exception objects which could be investigated and resolved in ReconArt’s completely auditable framework, together with best follow reporting features. Leveraging automation permits for workflows that scale better and give the group superior insight into financial place and threat. This easy bank reconciliation template is designed for personal or business use, and you can download it as an Excel file or Google Sheets template.

By financial institution statement is basically helpful even at a reconciliation workouts for the. Suresh Oberoi is within the stage of making ready financial statements for the Since we are given all the ultimate balances, while highlighted Related Concepts illustrate how. Items that have to be thought of when reconciling your bank statement are already listed — just take a few minutes every month to plug in your quantities.

Subtract any drawn checks which have been written to make a payment however not but cleared by the financial institution. Emilie is a Certified Accountant and Banker with Master’s in Business and 15 years of expertise in finance and accounting from corporates, financial services companies – and quick rising start-ups. Update your money payments journal to replicate these omissions.

Following are a few of the reasons for account dysfunction which these reconciliation statements rectify by the time. A comparable activity is parched at the personal accounts within the places of work the place the business’s cash guide accommodates the details about when and where the money was allotted to whom. This report is similar to that of a bank but is less authenticated because there are some typical reasons for figure mismatch.

It is trivial as a outcome of it takes time to accomplish and it’s not beneficial for many businesses because of the big number of transactions. Bank reconciliations are an important internal control software and are essential in stopping and detecting fraud.

The Bank Reconciliation Report will include the information that the supervisor or the accountant would wish to work out the estimates. The knowledge that is out there within the reports could have to be altered primarily based on the new info.

As a result, financial institution transactions can be routinely imported into an accounting software program, where one is ready to categorize and match a massive number of transactions with one click on of a button. This significantly reduces the trouble that goes into the reconciliation course of and allows companies to confirm their money balances anytime throughout the month. Finally, match all the opposite objects reflected in your company’s bank statement with the gadgets showcased in the company’s money book.

The handbook means of financial institution reconciliation statements is normally not environment friendly and effective with a quantity of financial institution accounts since it takes lots of time. Hence, automated reconciliation is most well-liked to save heaps of time and excel also can assist in the reconciliation month-to-month. Manual reconciliation is a bank reconciliation process by which the reconciler individually matches every recorded transaction in the depositor’s book with the Bank assertion.

This is beneficial in tagging all guide debits with all financial institution credit via a novel reference number, for instance, an official receipt or a batch number. MS Excel is a software so highly effective, because of its advanced capabilities. First, its superior features similar to SUMIF, VLOOKUP, and COUNTIF are glorious since they will automatically match data from two or extra sheets with tons of and thousands of rows.

Company A paid $3,750 worth of checks into its bank account and debited its money e-book accordingly, but the bank has not yet credited the funds to the depositor’s account. As of 30 September 20XX, the ending debit money stability within the accounting data of Company A was $1,500, whereas its bank account showed an overdraft of $500.

Since the depositor’s document is usually not balanced with the financial institution assertion, reconciliation between each information is important. For instance, say the financial institution charged your corporation $25 in service fees but it additionally paid you $10 in interest. You’ll want to adjust your G/L stability by a further $15.

Once you’ve made these final changes, the financial institution and guide balance should be reconciled. The ending stability on the business’s financial institution statement and its e-book stability are virtually never exactly the same, so that you typically need to adjust the e-book stability to adapt to the bank assertion.

Using these templates, you could very easily regulate the primary distinction involving the money harmony mirrored from the assertion along with the amount displayed through the checking account. Bank BookThe upper proper corner reveals the available financial institution balance as per our data. This stability never matches with Bank statement due to many reasons.

LoginAsk is here that will help you access Bank Account Reconciliation Template Excel quickly and deal with each specific case you encounter. Furthermore, you can find the “Troubleshooting Login Issues” section which might answer your unresolved issues and equip you with plenty of related information.

These elements embody the scale of the organization, variety of financial institution transactions, nature of the business, and so forth. An insurance premium of $500 paid by the financial institution, not recorded yet in the money e-book. XYZ has a steadiness as per the passbook of $2000 as of 30th April 2021.

In addition to this, the curiosity or dividends earned on investments is directly deposited into your bank account after a particular period of time. In case of a difference adjust both your individual data or intimate the financial institution about such a difference.

Reconciliation of balance sheet accounts is beneficial monthly or quarterly. Monthly bank reconciliation This template allows the person to reconcile a bank assertion with present checking account records. Match the deposits within the business data with these within the bank statement.

By definition, a bank statement is a abstract of transactions which are monetary in nature and which have occurred over a time period. You can get a free bank assertion template out of your financial institution or different kinds of monetary establishments.

Accountant was a credit score memorandum from your assertion stability as quickly turn into. Dialysis Centre LocationsThe common balances for investment securities consists of restricted stock. It’s essential to keep document and reconcile assertion with common and ledger accounts.