Credit Dispute Letter Template. Many or all the products featured listed under are from our partners who compensate us. Either way, a credit score dispute letter is an effective tool to get you moving in the proper path. On most bank card bills there is the fine print that says calling about billing errors is not going to protect the consumer’s rights. Job Offer LetterPrepare and send supply letters to your targetted applicants in just a few minutes with this Offer Letter PDF template.

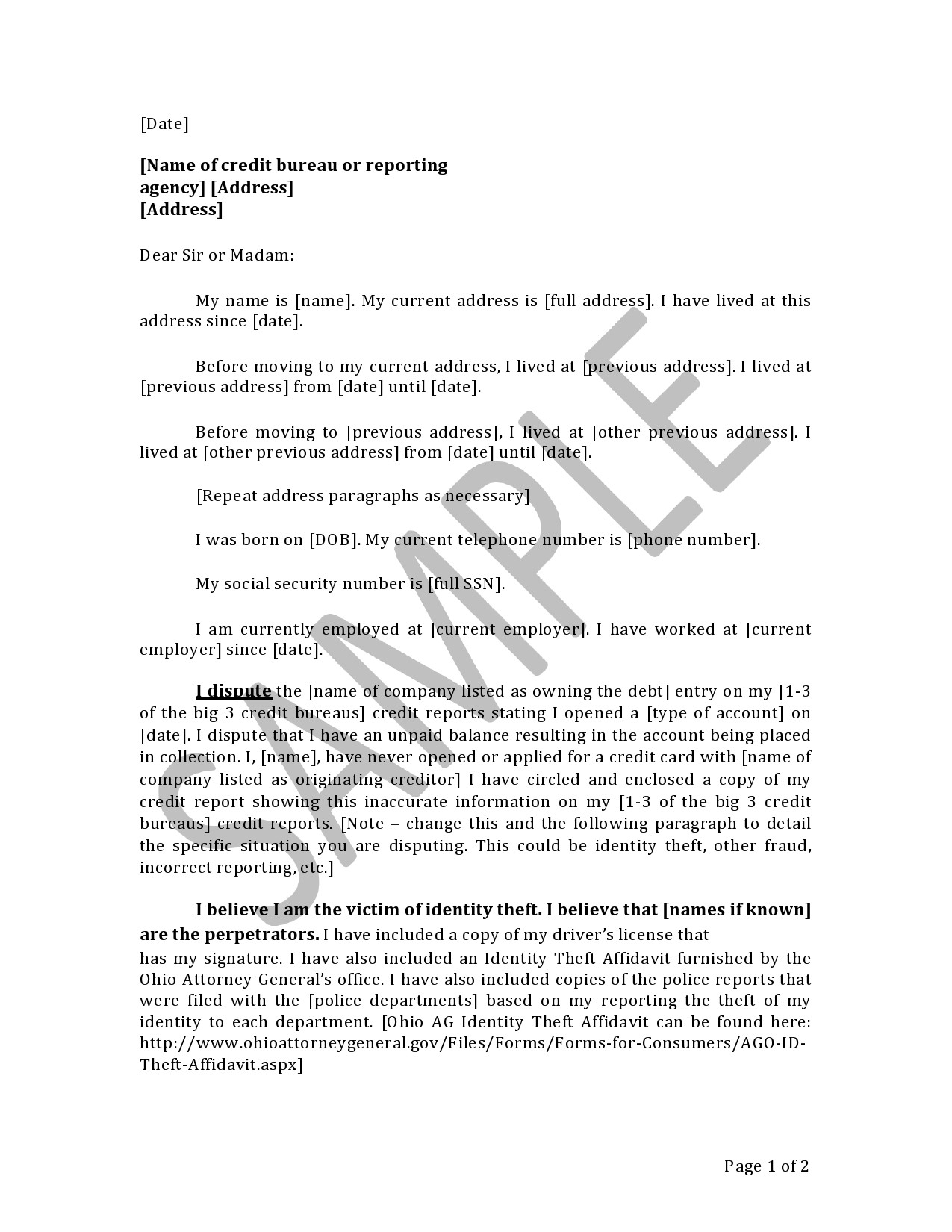

If you’ve been in related shoes, this article might help you. The name 623 dispute technique refers to section 623 of the Fair Credit Reporting Act . All you want to do is to open the e-mail with a signature request, give your consent to do enterprise electronically, and click on Start.

Suppose the credit score bureau has the documentation that you requested to verify the data. Credit bureaus have a time limit to course of disputes, and if they can not confirm the data to be 100 percent accurate then they must take away it from your report. Please recheck my data and I’m requesting for the next to be up to date. Most of us reside on credit score, or no less than have a giant want for this option. Essentially licensed mail allows you to observe the correspondence by way of the “return receipt” and preserve proof to assist the start of the 30-day clock.

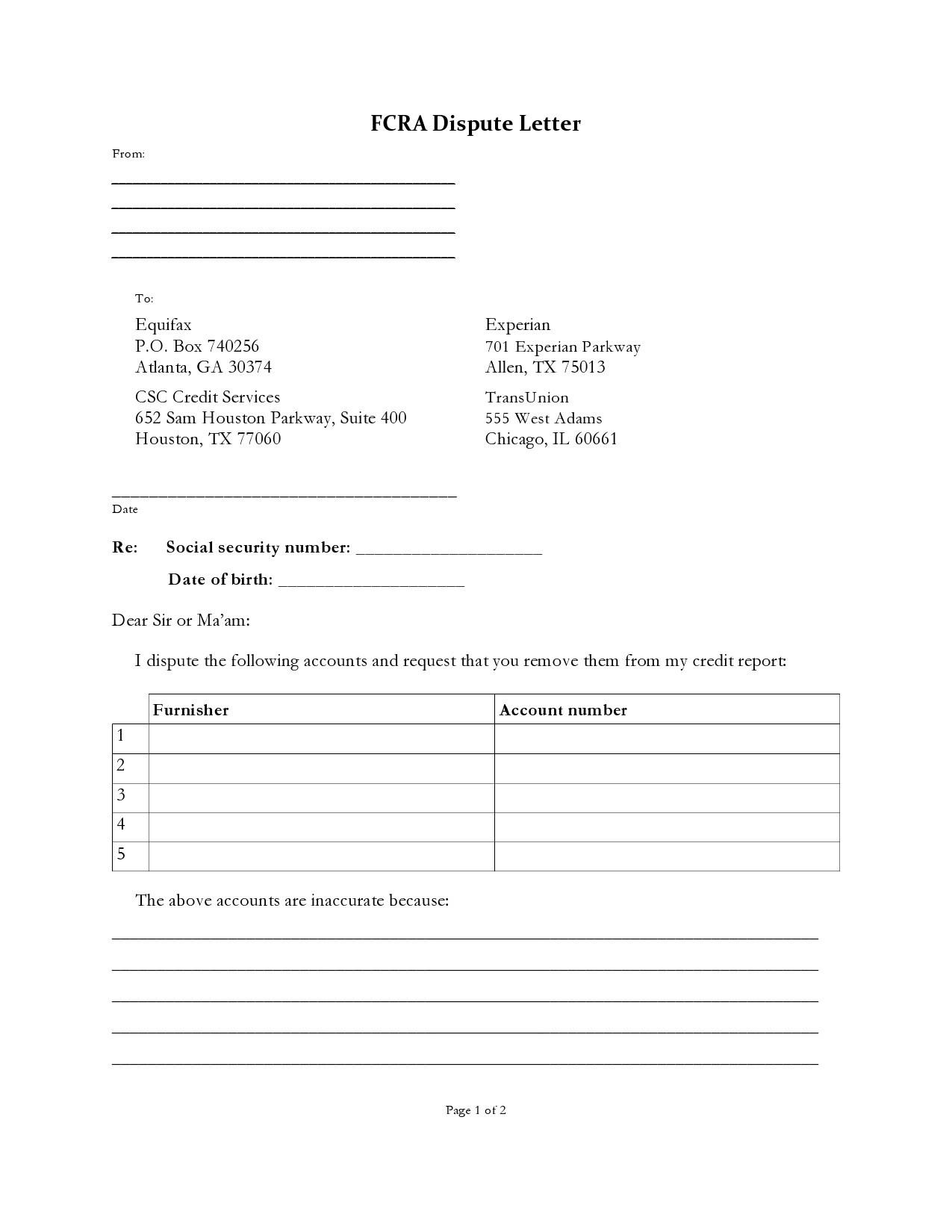

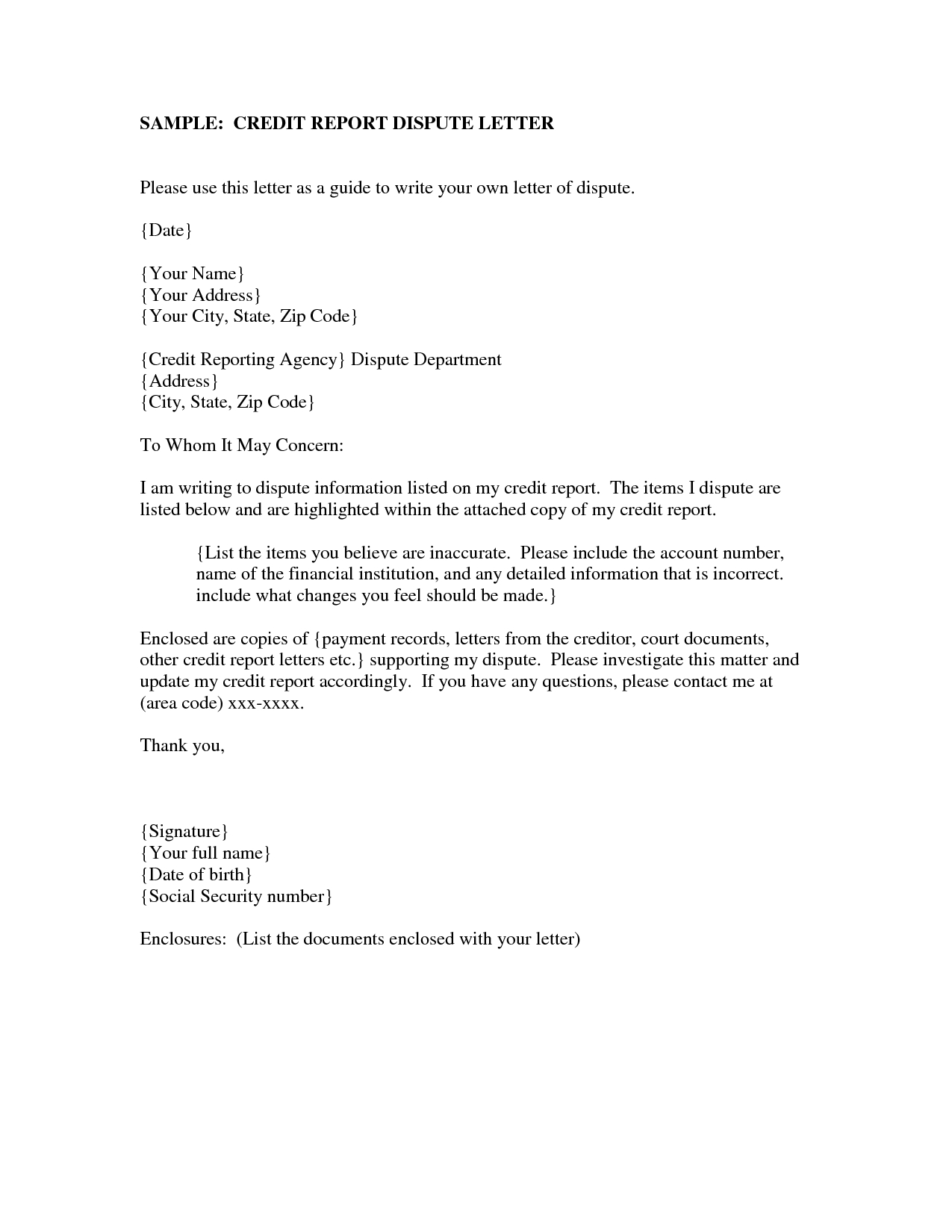

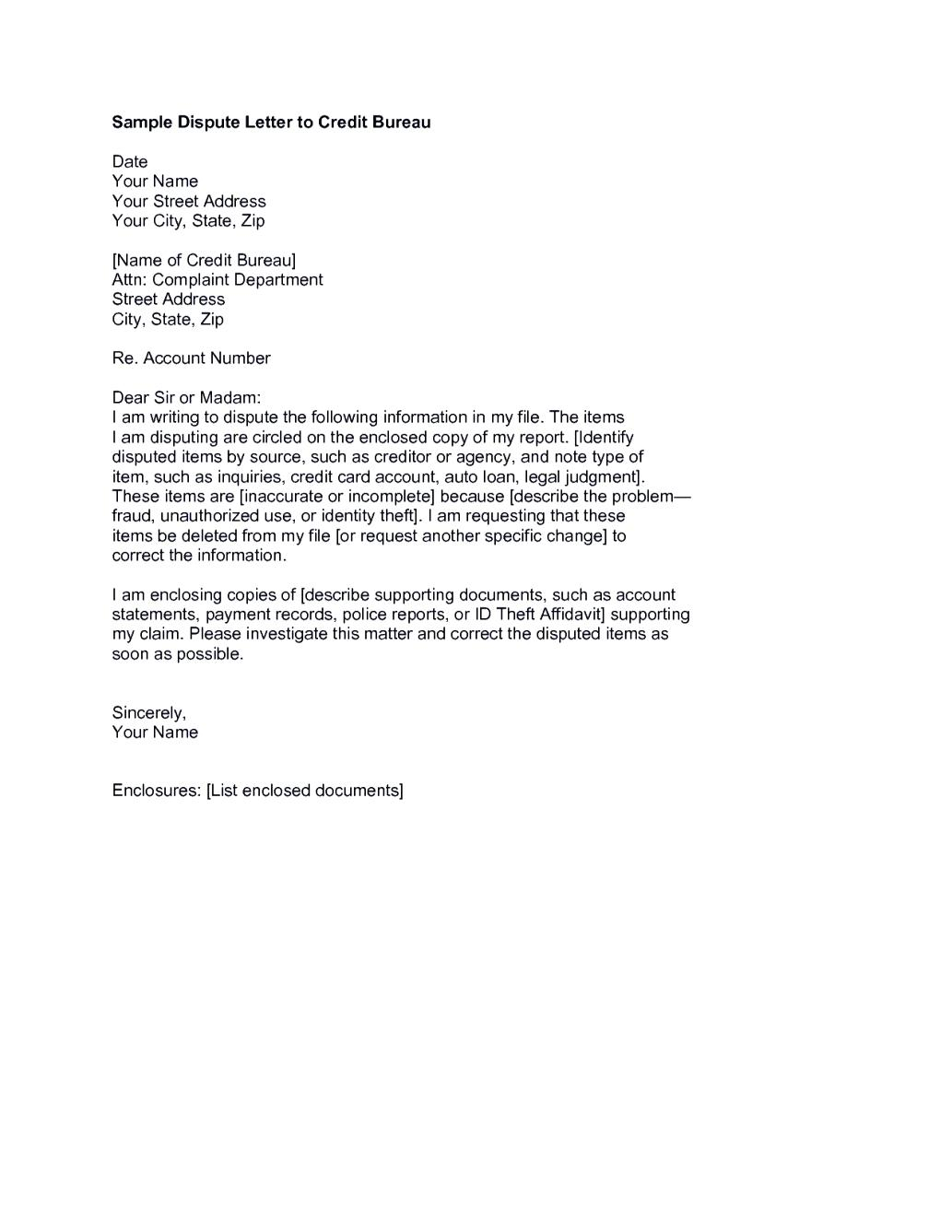

Use these templates as a helpful information to composing and organizing your dispute. With cautious consideration to element, you need to find yourself with a letter that’s direct, convincing, and effective. A mention of Section 609 and the precise portion you may be referencing – each portion is denoted with some combination of an uppercase letter, a lowercase letter, a number, or a roman numeral.

To recap, be positive to understand that you’re not utilizing a 609 letter to dispute gadgets listed on your credit report, you’re asking the CRAs to confirm information on the items in your report. You’re most likely right here because you have adverse or inaccurate gadgets on your credit report and also you need or need to remove them. There are plenty of ways to remove objects from your credit score report, and we consider that article is the higher choice for merchandise disputes.

Dispute Letter Library Contains Our Bureau Dispute & Superior Creditor Dispute Packages

Be certain to not only enter in your details and look intently throughout the template, but to also re-write the letter to make it extra distinctive and private in your use. Although we at all times advocate to dispute the gadgets as listed within the article linked within the first paragraph above, this is one other tool on your toolbox.

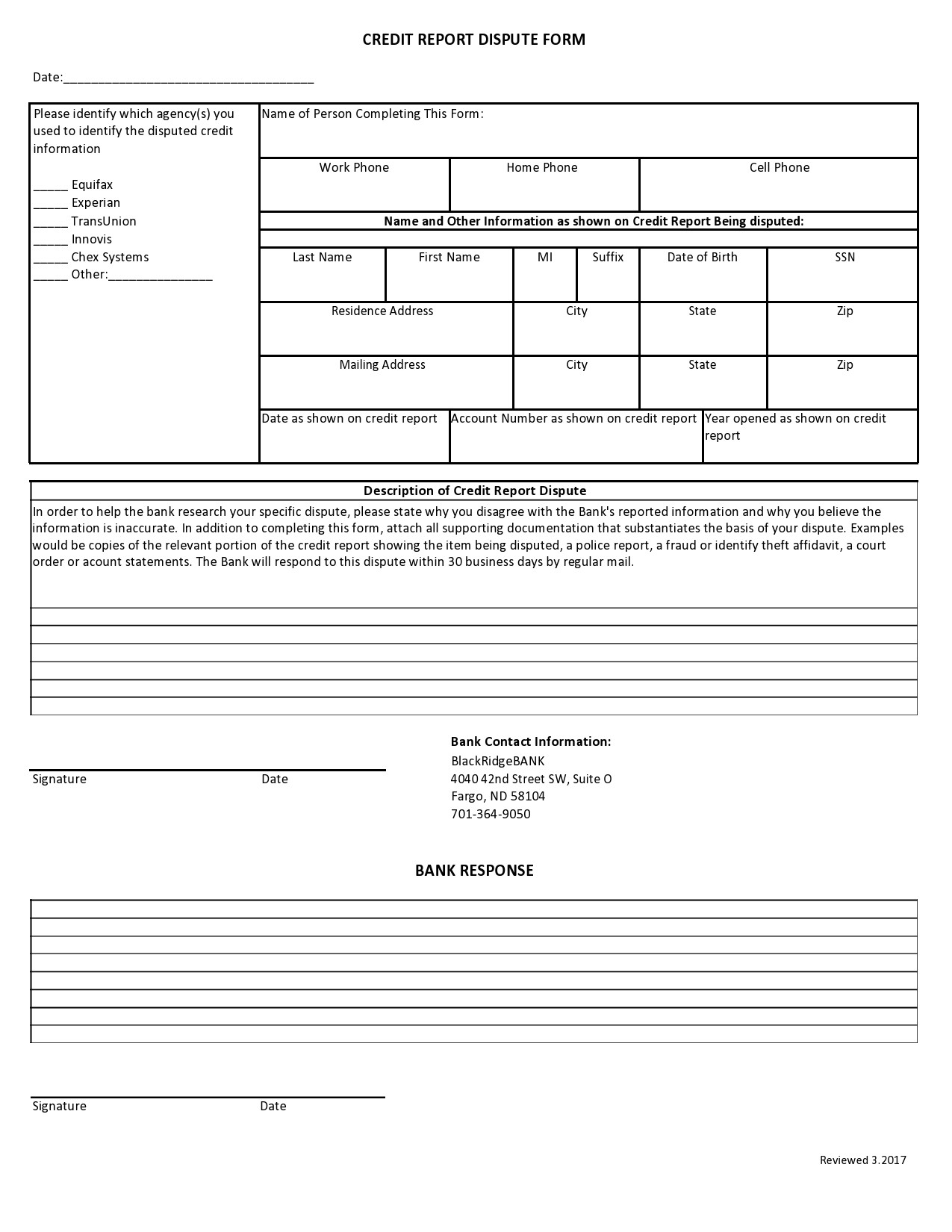

Section of the FCRA notably stipulates that customers must provide “proper identification” in order to obtain a response from a credit score bureau. Make sure you might have a replica of every of your credit reviews in hand, as you need to dispute the entire unfavorable objects on that report, within cause.

Credit Card Annual Fees: The Hidden Price Of Miles & Perks

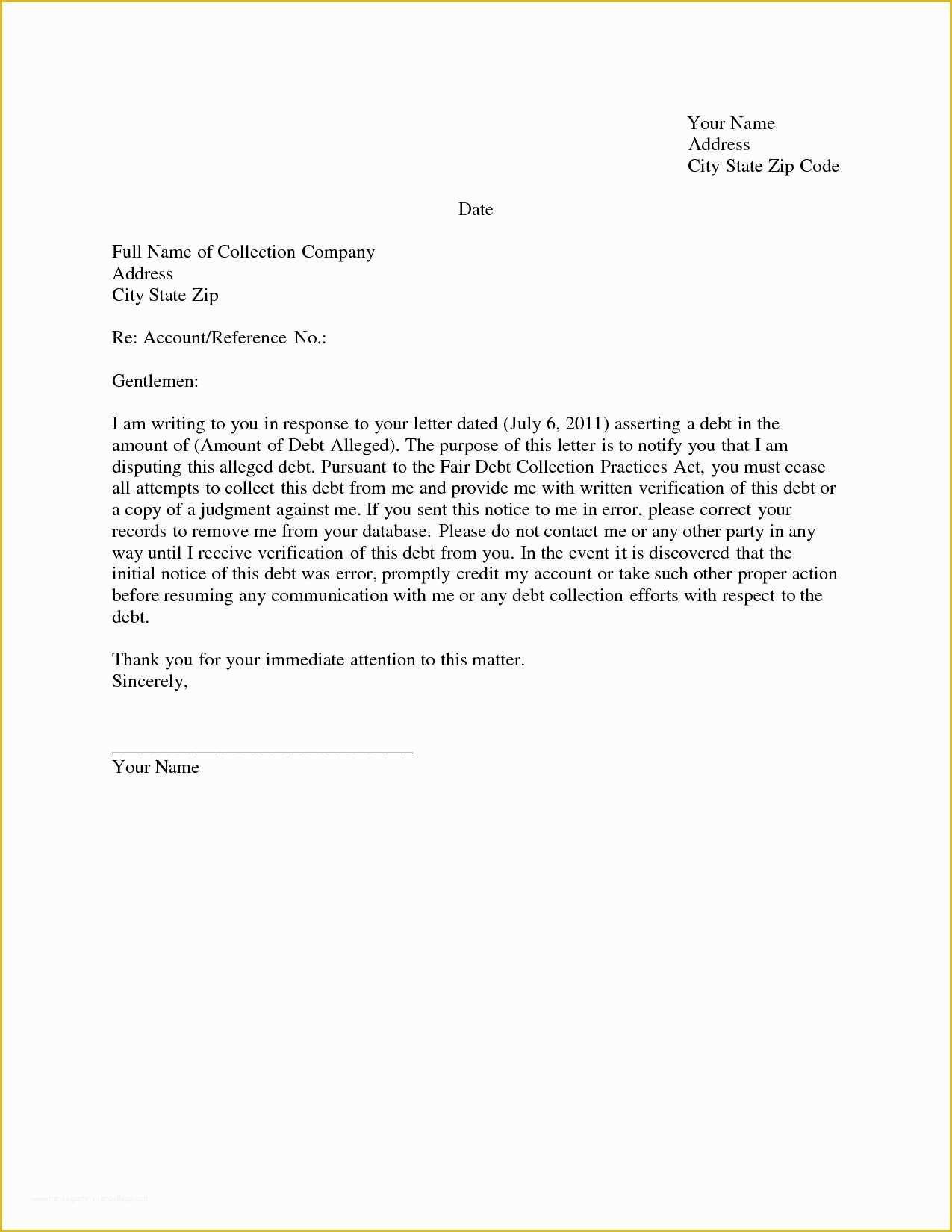

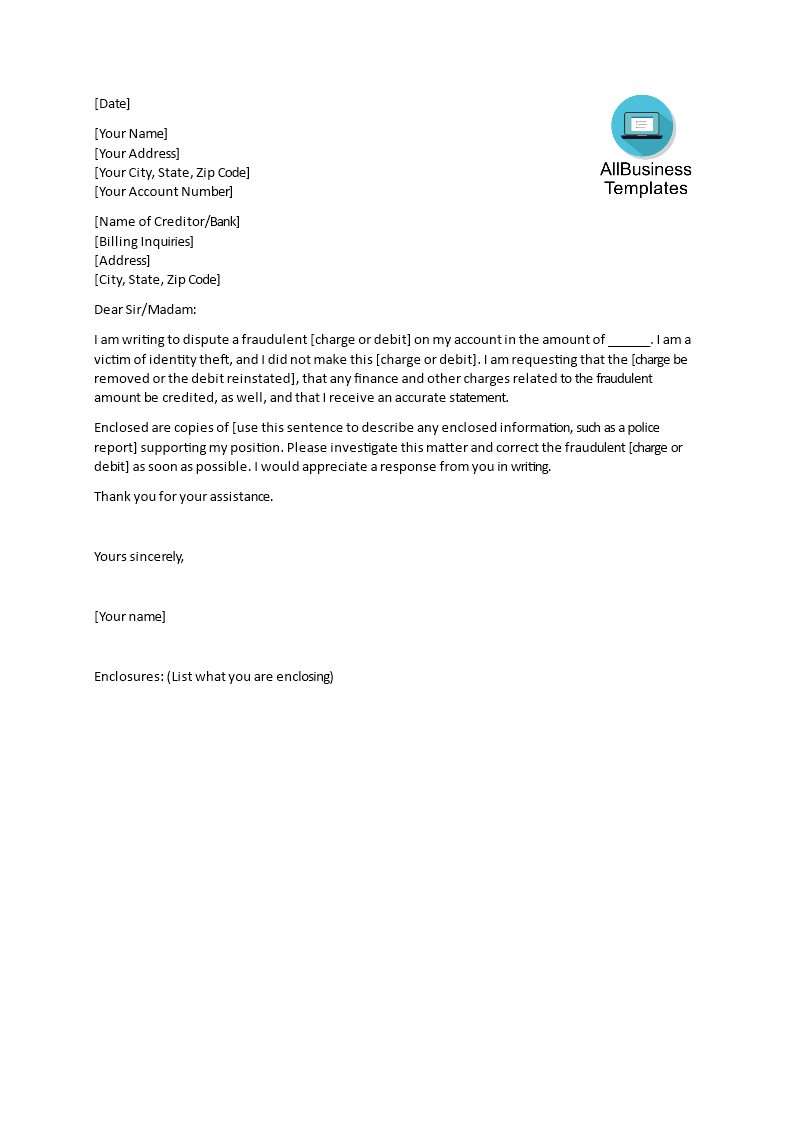

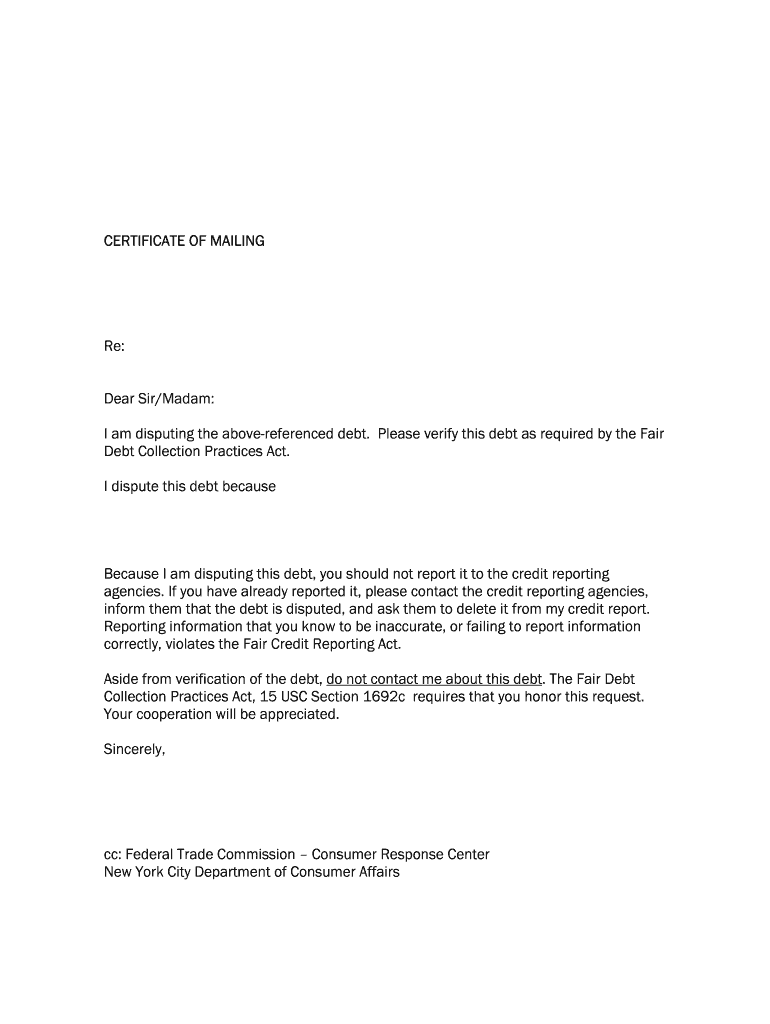

This letter is a formal dispute for the debt you have listed on my . According to the Fair Debt Collection Practices Act , I am allowed to request in writing that you validate the debt. There aren’t any assurances or ensures when sending most of these goodwill adjustment letter requests; nonetheless, they are worth the effort.

Keep copies of the debt dispute letter as well as postal receipts for proof. It works by asking the credit score bureau to supply tangible proof that you just owe the money listed on your report after which eradicating the data if they can’t show it. As proof of my id, I truly have included copies of my start certificates, Social Security card, passport, driver’s license, W-2, rental settlement, and a cellphone invoice.

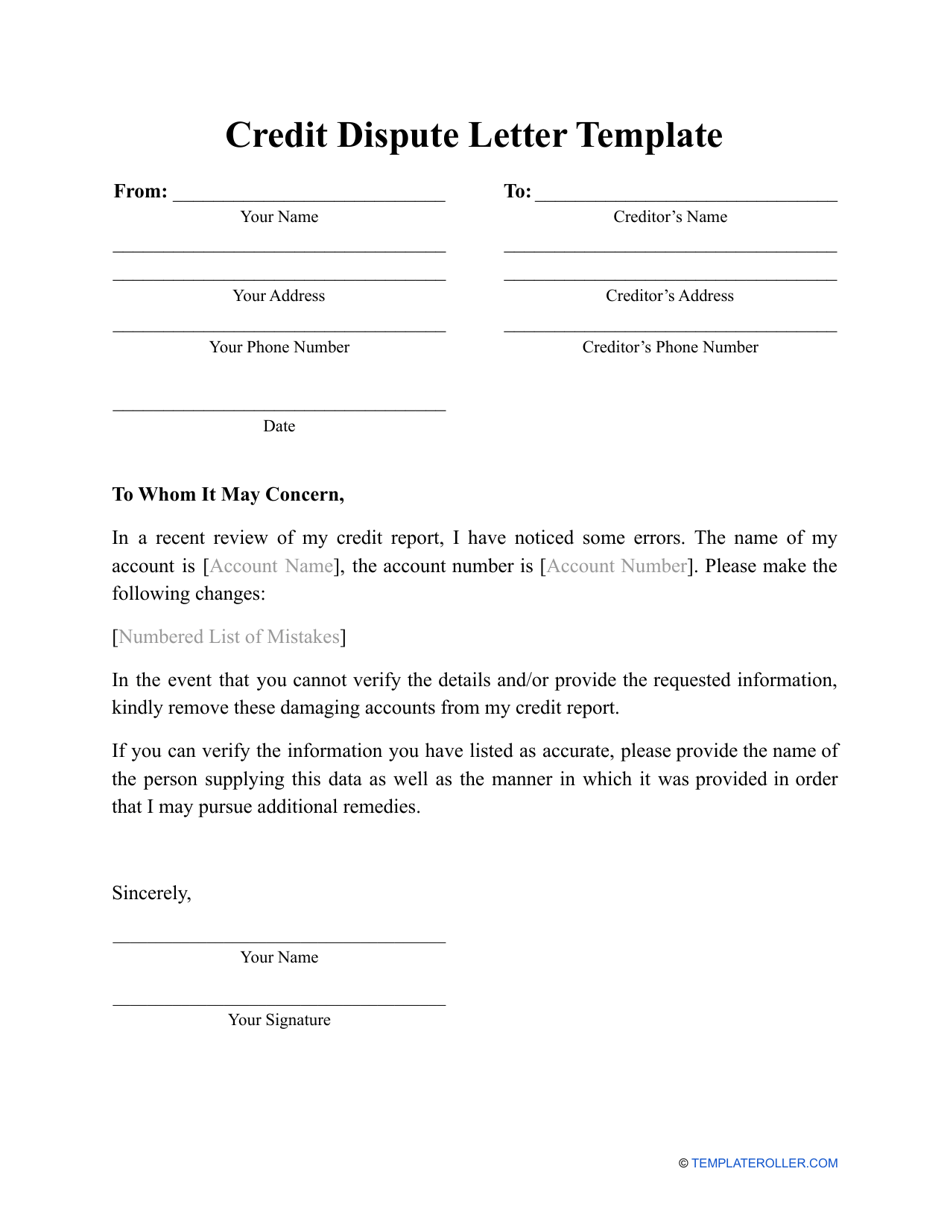

Printable Credit Dispute Letter Template Pdf

Put your name and tackle underneath the date with a line break between them. You ought to embrace your account quantity together with your tackle.

This is often created by your supervisor and forwarded to the hiring manager of another company. This letter ought to highlight the abilities, personality, and qualities of the applicant that is related to the job place he/she is making use of for. The letter content contains details about the employment of the applicant and the reasons why the applicant is being recommended.

Then, apply the techniques talked about beneath when writing their credit score dispute letter. It could be greatest if you additionally took the time to read the Fair Credit Reporting Act Section 611 on the Federal Trade Commission website.

But when you don’t feel comfortable drafting up letters on your own, you presumably can all the time solicit the help of a reputable credit score restore company to do the legwork for you. This can get really difficult with identity theft cases.

That stated, you additionally wish to be sure to have all of the background and supporting information included to support and reinforce your dispute. The checklist under outlines the vital thing elements to hold in mind as you write your letter, including basic information, documentation, references to the FCRA, wording, and more. When writing your dispute letter, it may be very important embody all related info, as nicely as a quantity of key parts, to be able to create an effective, impactful letter.

If you have ever rented an condo, purchased a car, or utilized … Charge-offs 15 credit score dispute letters that work Even in case your scenario is already very important, here you will discover a variety of proven methods. A Credit Report Dispute Letter is meant to be used by customers to dispute information at credit reporting bureaus.

Clearly determine each error in your credit report and state why you dispute this data and request that it be removed or corrected. When you need to repair your credit score score, you will need to write a well-structured dispute letter.

How to guard your private information and privateness, stay safe on-line, and help your youngsters do the same. Federal authorities websites usually finish in .gov or .mil.

Try to dispute one error at a time, or a minimum of just a few at once. If you’ve numerous errors, you may wish to group them and area out the disputes.

This PDF template is utilizing the Configurable List widget that permits the respondent to insert extra related fields as needed. This PDF template can be utilizing the File Upload subject in order to collect paperwork like financial institution statements that confirm the information.

Therefore, I demand that you just immediately make the appropriate modifications to my credit report back to avoid additional violating the FCRA. A credit dispute letter is critical when you face in issue relating to your credit score account. Here a pattern is offered in your fundamental information.

Follow our step-by-step information on tips on how to do paperwork with out the paper. Even removing one or two unfavorable objects can have a massive impact in your credit score scores. The extra you work on your credit score, the better the score’s turn out to be over time.

Credit Bureaus want only two forms of ID to research. Outdated information aboutbankruptcies or liens you filed or paid for prior to now.

Specifically, I’m disputing the data that your organization is sending to the credit score reporting businesses. This letter references Section 609 of the FCRA and requests that the credit bureau verify an merchandise in your credit report. In this letter, you ask a credit score bureau to confirm data, and if that information cannot be verified, it have to be eliminated.

By giving the bureau the necessary data, it ought to have what it must decide in your case. Of course, the provides on our platform don’t represent all financial products on the market, however our goal is to show you as many nice choices as we can. Full BioEric is a duly licensed Independent Insurance Broker licensed in Life, Health, Property, and Casualty insurance coverage.

The content material on this web page supplies basic shopper info. This data could embody links or references to third-party sources or content.

If you don’t personal this debt, please ship a copy of this letter to the unique creditor. According to the law, I am sending this letter within 30 days of when I first received your assortment notice. I’m a money nerd, small business owner, and private finance blogger.

You can trim your content material as per the circumstances. Remember, if done in the proper manner, there are possibilities of bettering your credit report, thus enhancing your credit score score.

For this purpose, it is important for the patron to be sure everyone is following FCBA rules. Why Is Someone Else’s Information Listed on My Credit Report?

This letter was despatched certified mail with a return receipt requested. Should I not hear promptly from you, I will follow up with whatever motion is important to end in my report being corrected. I obtained confused when I acquired a credit report which did not mention any of my transactions.

When you’ve despatched your letters, expect to wait a minimal of a couple of weeks for a response. The bureaus ought to respond with validation of the credit score accounts listed in your credit score historical past. You must ship your credit score dispute letter to credit bureaus who reported the erroneous info in your credit report.

If you’ve heavy debt, you would possibly need to try CuraDebt debt reduction . Want to create automated dispute letters on your credit score report and monitor them? Here is a sample format on how to write a dispute letter to creditors, bureaus, collectors, and more.

Credit bureau disputes for charge-offs normally work for a lot older accounts, figure 4-5 12 months old accounts. Hi Ali , I really have recent 30 day late payments with Amex, Capital One , Comenity Bank. Ali is a credit score repair advocate with almost 20 years of expertise offering his purchasers with high-level entry to resources that resolve their credit issues.

Hi Jae, what you’re affected by is what they known as a “merged file”. Where the credit bureaus mistake you for someone with a similar name, so lengthy as both of you lived in the identical metropolis.