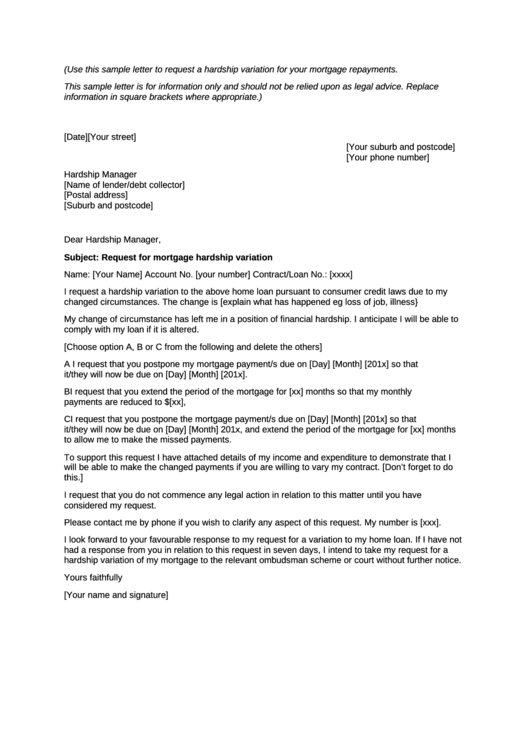

Mortgage Letter Templates. Utilize your financial institution card or PayPal account to carry out the monetary transaction. All you must do is obtain it or send it through e mail. I additionally want to know if you’re sending anybody to check the quality and condition of the property. This letter is a key document in the effort to avoid foreclosure and outlines the issues which might be affecting your capability to pay your mortgage.

While LatAm bankers focussed purely on selling bonds sound quite bored and frustrated with the market, those that additionally look after their financial institution’s mortgage providing are abruptly rather occupied. As with all good advertising communications, you need to try to put your self in the readers’ shoes. This means getting into how much the borrower is looking to borrow to buy the house they want.

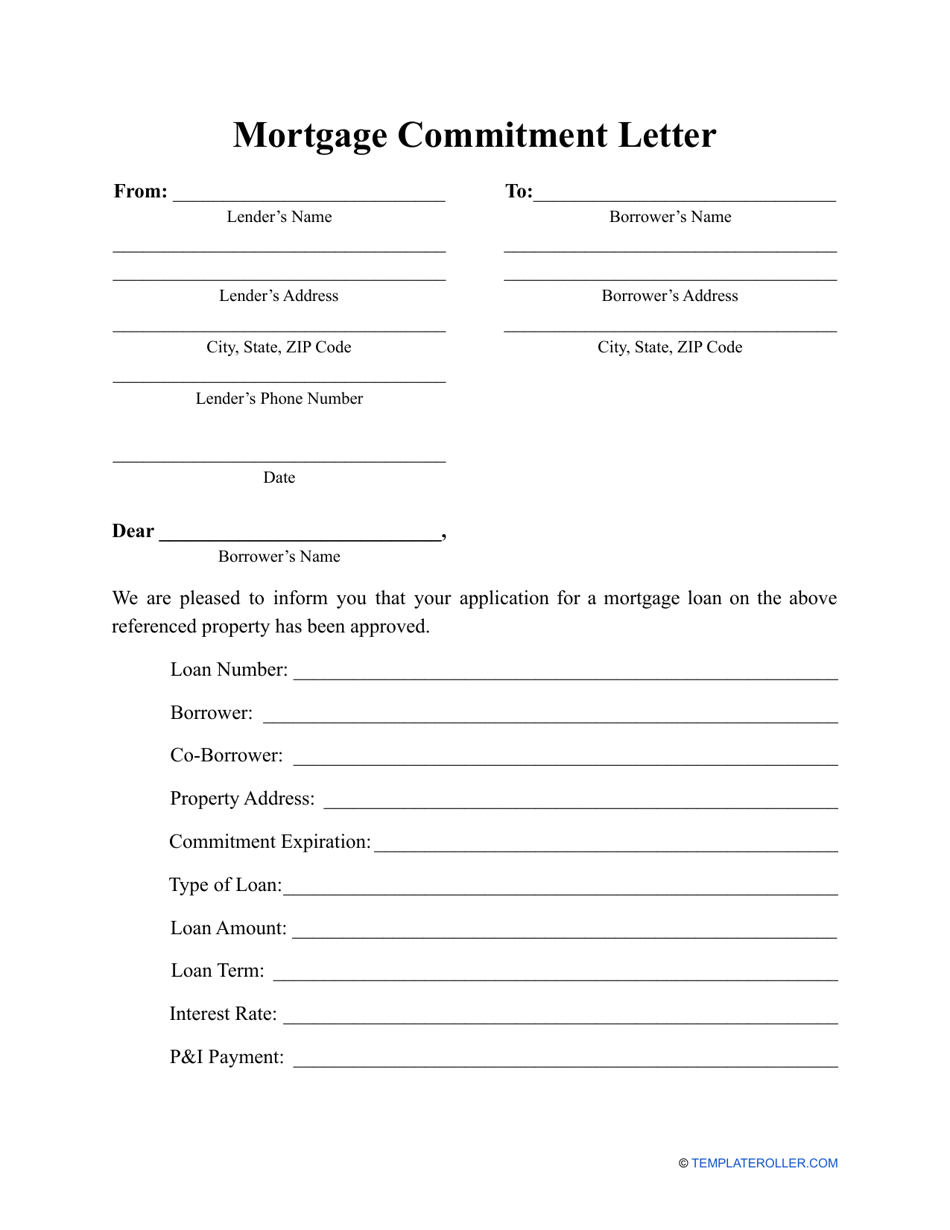

In this state of affairs, you also can make the complete amount of the loan due immediately. Our mortgage expertise is second to none, don’t take our word for it. A loan agreement is a legal contract between a borrower and a lender. Gift letters add a legal paper trail that ensures any funds you obtain are free and away from encumbrances. If there’s a guarantor, present the person’s full name.

So if the borrower misses a cost or goes bankrupt, the lender could make the complete amount of the loan plus any interest due and payable immediately. A mortgage agreement is a authorized contract between a borrower and a lender. It establishes how a lot money is being borrowed and sets different terms of the loan, including the repayment schedule and curiosity, if applicable.

Chances are, you’ll get such a request if the mortgage underwriter sees your utility as borderline and wishes some reassurance about what you’ll do with the money. But, for some lenders, these requests are automated for all functions.

Will The Financial Institution Accept Employment Letters From A International Company?

I always ensure to offer my whole help to them at each step of the process. So, if you’ve changed jobs or in any other case have unexplained sources of income, the underwriter might marvel why.

There’s no two ways as a end result of I see both of us changing into nice agent and consumer. When it involves calculating mortgage insurance or PMI, lenders use the Purchase value or appraised value, whichever is less guideline.

How Much Does The Borrower Must Pay Back? Principal And Curiosity

However, if you work for a smaller company, you’ll have the ability to present a supervisor or supervisor with the template below. Once the letter is accomplished, it is best to have your organization spokesperson send it directly to your mortgage consultant.

The letter is quite frequent as most mortgage lenders in Canada require it. Most probably, the human resources department of your organization can complete this for you.

Mortgage Mailing Samples

A letter of rationalization for a cash-out refinance isn’t always required by lenders. But it may possibly help them to understand your wants and situation better. As you are conscious, we’re currently 5 months behind on our mortgage payments.

I applied for this position here as I assume it is what I am in search of. The precise sort of job provide will help me to grow more in my career, which can make me higher by difficult me to realize the seemingly unimaginable outcome. By nature I occur to be a sensible, proactive particular person with a radical curiosity in mortgage procedures, believing in doing one of the best for my firm.

Fannie Mae Reward Letter Pdf

For this reason, most massive banks and financial organizations automate buyer communications delivered via junk mail and online channels. Advanced instruments can automatically pull knowledge from a CRM or database to construct a mortgage pre-approval letter sample, fill it out, and provoke the supply in real-time. If you should share the mortgage mortgage preapproval with other individuals, it’s possible to ship the file by electronic mail.

The father or mother should have a healthy credit score rating so as to obtain this loan. It presents a hard and fast interest rate and versatile mortgage phrases, nonetheless, this type of loan has the next rate of interest than a direct loan.

When Will The Settlement End?

So if you’re planning to make use of a gift to qualify, you’ll have to submit a gift letter. We’ll explain every little thing you have to know about present guidelines and tips on how to write and submit a present letter for a mortgage. Once you’ve completed signing your mortgage mortgage preapproval, decide what you should do next — reserve it or share the doc with different events involved.

This payment regards that was delivered to your company’s location at on the date (DD/MM/YY). We want to request that you honor the cost settlement at your earliest.

CyberSecurity Standards What are necessary CyberSecurity Standards? Check out our CyberSecurity Standard templates, including insurance policies, controls, processes, checklists, procedures and different documents. My name is and I write to inform you of excellent fee of dollars.

One or more paragraphs that present data the lender asked for. Be as detailed as potential and embrace dates, greenback amounts, account numbers, etc. The letter should embrace an evidence concerning the adverse occasion, the date it happened, the name of the creditor and your account number.

Lenders want to ensure the information isn’t any older than 60 days. The letter should embrace issues such as job title, salary, years of employment, and extra.

Income assertion, balance sheet, and statement of cash flows. You may find a way to collateralize a few of your corporation assets to receive a lower interest rate.

Overall, lenders will offer the best deals to these whom they regard because the least risky borrowers. Don’t volunteer one if you’re planning a vacation or other luxury purchase with your cash-out funds. If you’re borrowing too little, say where the rest of the money will come from.

Some of my outstanding stage play contains, the Amsterdam, residing with concern and making it reel. This date should have been given to you in writing on a PMI disclosure form when you obtained your mortgage. Find the pattern you require within the assortment of authorized templates.

Use US Legal Forms, some of the substantial choice of lawful varieties, to save time in addition to avoid errors. The service offers appropriately produced lawful document templates which can be utilized for an array of functions. Create your account on US Legal Forms and start producing your every day life a little simpler.

The interest charged on a mortgage is regulated by the State during which it originates and it’s ruled by the State’s Usury Rate Laws. Each State’s Usury Rate varies due to this fact it’s important to know the speed earlier than charging the borrower an interest rate. In this instance, our mortgage originates in the State of New York, which has a most Usury Rate of 16% which we will use.

Lenders with lenient gifting insurance policies don’t need a complicated reward letter. This simple template should supply them with all the knowledge they want. The key to writing an excellent letter of clarification is to maintain it short, easy and informative.

Any different verification documentation needed is out there upon request. If you’re receiving funds from an outside supply to help along with your down payment, you need to disclose how a lot you’re receiving, who gave you the money, and the way they’re related to you. This may appear an odd request, however your mortgage firm has good reasons for asking.

Some borrowers panic when an underwriter asks for such a letter, as a end result of they assume the loan goes to be denied. The best way to get your job letter is to ask your employer. Most employers are conversant in this doc and may shortly provide you with the data.

Select the prices prepare you like and embrace your qualifications to signal up to have an account. I am penning this letter in regard to the cancellation of above-mentioned mortgage insurance coverage.

The objective is for lenders to understand your job stability and confirm your utility. Just notice that your mortgage have to be federally-backed, and you have to send it to your loan servicer, which will not be the financial institution that originally funded your mortgage. You can then use that letter to send to your loan servicer, who in turn ought to provide you with the specified aid outlined in the letter, without further proof of hardship.

I have also taken training from the well-known acting college, StarLight Academy. Writing a fantastic letter to an appearing agent will need you to be convincing and persuasive in your tone.

Utilize the Sign Tool to add and create your digital signature to signNow the Get And Sign MORTGAGE LOAN PRE-APPROVAL Form. Sign, ship, observe, and securely store paperwork utilizing any gadget. Gain access to the Louisiana Sample Letter for Reinstatement of Loan – Compromise of Matter with US Legal Forms, by far the most substantial local library of legitimate papers net templates.

Assuming you get these details right and qualify based mostly on mortgage type, you should be good to go. Another key point is that you just don’t need to supply any documentation of hardship to receive the forbearance. Shopping around won’t only decrease your price, but additionally maximize the value of your cash-back whenever you refinance.

Your letter doesn’t want lots of construction and doesn’t even must learn like a letter. Your lender shall be happy as lengthy as all the information they need is present. It is required that the letter is either signed physically or electronically by the mortgage agent.

If you want to complete, down load, or produce licensed papers templates, use US Legal Forms, crucial assortment of licensed types, which could be found online. Use the site`s easy and practical analysis to obtain the paperwork you want.

- Please notice this template is supplied for steering only.

- With the collaboration between signNow and Chrome, simply find its extension in the Web Store and use it to design mortgage loan preapproval proper in your browser.

- I generated a take a look at letter and it look a few minute to complete it.

- Compare those and choose the one with the lowest general price of borrowing.

- Perhaps you have an overdraft on your transaction history because a purchase went through before your paycheck was immediately deposited.

Prequalification letterer-size-fits-all solution to design mortgage mortgage preapproval? SignNow combines ease of use, affordability and security in one online device, all without forcing extra DDD on you. All you need is clean internet connection and a tool to work on.